A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

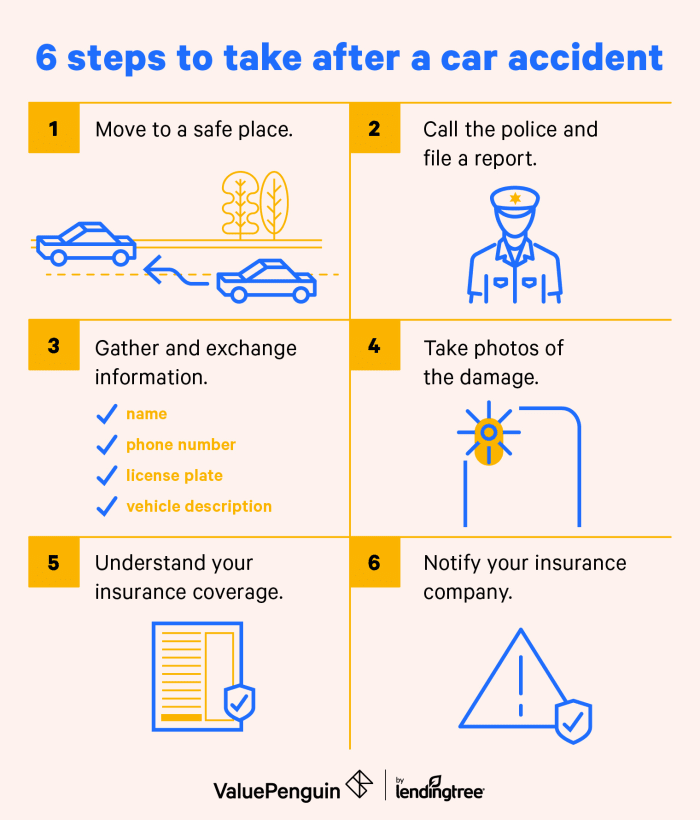

Car accidents are an unfortunate occurrence that can happen to anyone at any time. Even if you have car insurance, it can be overwhelming to know what steps to take after an accident. This is why it is important to be prepared and informed on what to do after a car accident insurance.

Firstly, it is important to prioritize your safety and seek medical attention if necessary. Then, gather as much information as possible about the accident, including the other driver’s insurance information and any witnesses. From there, you can contact your insurance company and begin the claims process. Knowing the proper steps to take can make a stressful situation more manageable.

After a car accident, you should immediately contact your insurance company to report the incident. Provide them with the necessary information, such as the location and time of the accident, and any injuries sustained. Your insurance company will guide you through the next steps, such as getting your car repaired and filing a claim. Be sure to take photos of the accident scene and obtain contact information from any witnesses.

What to Do After Car Accident Insurance?

Car accidents can be a traumatic experience, and dealing with the aftermath can be just as stressful. If you have been in an accident, it is important to know what to do next. Here are the steps you should take after a car accident and how your insurance can help.

1. Stay Calm and Safe

The first thing you should do after an accident is to stay calm and safe. Move your vehicle out of traffic if possible, and turn on your hazard lights. Check yourself and your passengers for injuries, and call for medical assistance if needed. If you are unable to move your vehicle, turn off the engine and wait for help.

2. Exchange Information

After ensuring your safety, exchange information with the other driver(s) involved in the accident. This includes names, contact information, license plate numbers, and insurance information. Take photos of the accident scene, including any damage to the vehicles and any injuries.

3. Contact Your Insurance Company

Contact your insurance company as soon as possible after the accident. They will guide you through the claims process and help you understand what you need to do next. Provide them with all the information you gathered at the accident scene.

4. File a Claim

Your insurance company will help you file a claim and start the process of getting your vehicle repaired or replaced. They will also help you understand what expenses are covered by your policy and what your deductible is.

5. Get Your Vehicle Repaired

Once your claim has been processed, you can get your vehicle repaired at a licensed repair shop. Your insurance company may have preferred repair shops that they work with, or you can choose your own. Make sure to keep all receipts and documentation related to the repairs.

6. Understand Your Coverage

Understanding your insurance coverage is important before and after an accident. Make sure you know what your policy covers and what it does not. This can help you make informed decisions about your coverage and any additional insurance you may need.

7. Consider Additional Coverage

After an accident, you may want to consider additional coverage to protect yourself and your vehicle in the future. This can include collision coverage, which covers damage to your vehicle in case of an accident, or comprehensive coverage, which covers damage to your vehicle from other events like theft or weather.

8. Monitor Your Insurance Rates

After an accident, your insurance rates may increase. It is important to monitor your rates and make sure you are not overpaying for your coverage. You may be able to save money by shopping around for insurance or adjusting your coverage.

9. Take Care of Yourself

An accident can be a stressful and traumatic experience. Take care of yourself and your mental health after an accident. Seek out counseling or support if needed, and speak with your insurance company about any mental health benefits that may be available to you.

10. Drive Safely

The best way to avoid an accident is to drive safely and follow all traffic laws. Always wear your seatbelt, avoid distractions while driving, and never drive under the influence of drugs or alcohol. By being a safe and responsible driver, you can help prevent accidents and keep yourself and others safe on the road.

In conclusion, knowing what to do after a car accident can help you navigate the claims process and get back on the road as soon as possible. By following these steps and working with your insurance company, you can take the necessary steps to recover from an accident and protect yourself in the future.

Frequently Asked Questions

Car accidents can be a stressful experience. Knowing what to do after a car accident insurance can help you minimize the stress and ensure you get the assistance you need. Here are some commonly asked questions and answers:

1. What should I do immediately after a car accident?

First, make sure everyone is safe. Call for medical assistance if needed, then contact the police to report the accident. Gather important information such as the other driver’s name, contact information, and insurance details. It’s also helpful to take pictures of the scene, including any damage to the vehicles. Contact your insurance company as soon as possible to report the accident.

It’s important to avoid admitting fault or discussing the accident with anyone other than the police and your insurance company. This can help prevent any potential legal issues and ensure your insurance claim is processed quickly.

2. What does my car insurance cover after an accident?

The coverage you receive after a car accident depends on your insurance policy. Generally, car insurance policies cover damages to your vehicle, medical expenses, and liability for damages or injuries caused to others. Some policies may also include coverage for rental cars or roadside assistance.

It’s important to review your policy and understand your coverage before an accident occurs. This can help you make informed decisions if you need to file a claim.

3. How long does it take to process an insurance claim after a car accident?

The length of time it takes to process an insurance claim after a car accident can vary depending on several factors. This includes the complexity of the claim, the extent of the damages, and the cooperation of all parties involved. In general, insurance companies aim to process claims as quickly as possible. However, it’s important to note that some claims may take longer than others.

If you’re unsure about the status of your claim, contact your insurance company for an update. They can provide more information on the expected timeline for your specific claim.

4. What happens if the other driver doesn’t have insurance?

If the other driver is at fault and doesn’t have insurance, you may still be able to receive compensation through your own insurance policy. This depends on the coverage you have and the specific circumstances of the accident.

It’s important to contact your insurance company as soon as possible to report the accident and discuss your options. They can provide guidance on how to proceed and help you file a claim if necessary.

5. Will my insurance rates go up after a car accident?

Whether or not your insurance rates go up after a car accident depends on several factors. This includes the severity of the accident, the extent of the damages, and your driving history. In general, insurance companies may increase your rates if you’re found to be at fault for the accident.

However, some insurance policies include accident forgiveness, which means your rates won’t increase after your first accident. It’s important to review your policy and understand your coverage to know what to expect.

In conclusion, getting into a car accident can be a stressful and overwhelming experience. However, knowing what to do after car accident insurance can make a huge difference in the outcome of the situation.

First and foremost, it is important to exchange information with the other driver(s) involved in the accident and to contact your insurance company as soon as possible. This will help ensure that the claims process moves smoothly and efficiently.

Additionally, it is crucial to seek medical attention if needed and to document any injuries sustained in the accident. This documentation can be helpful in the event that legal action is necessary.

Finally, it is important to stay calm and level-headed throughout the entire process. Remember that accidents happen, and the most important thing is to prioritize your safety and well-being. By following these steps, you can navigate the aftermath of a car accident with confidence and ease.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts