A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Car insurance can be confusing for many people, especially when it comes to understanding the different types of coverage available. One type of coverage that you may have heard of is Personal Injury Protection, also known as PIP. But what is PIP exactly, and how does it differ from other types of car insurance coverage? Let’s dive in and find out.

Personal Injury Protection is a type of car insurance coverage that helps pay for medical expenses and other related costs if you or your passengers are injured in a car accident. This coverage is often referred to as “no-fault” insurance, meaning that it pays out regardless of who was at fault for the accident. In this article, we’ll take a closer look at what PIP covers, how it works, and whether or not it’s worth adding to your car insurance policy.

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. PIP coverage varies by state, but it typically covers medical expenses up to a certain limit, regardless of who is at fault for the accident. PIP coverage may also include coverage for rehabilitation expenses and funeral expenses.

Contents

- What is Personal Injury Protection on Car Insurance?

- Frequently Asked Questions

- What does Personal Injury Protection cover?

- Is Personal Injury Protection the same as Medical Payments coverage?

- Do I need Personal Injury Protection if I have health insurance?

- Is Personal Injury Protection required in all states?

- How does Personal Injury Protection affect my car insurance premium?

- What is Personal Injury Protection (PIP)?

What is Personal Injury Protection on Car Insurance?

Car accidents can be both physically and financially devastating, and Personal Injury Protection (PIP) is a type of car insurance coverage that can help protect you from the high costs of medical bills, lost wages, and other expenses that can result from an accident. In this article, we will explore what PIP is, how it works, and why it may be a smart choice for you.

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance coverage that is designed to cover medical expenses, lost wages, and other related expenses that may result from a car accident. PIP is often referred to as “no-fault” coverage because it pays out regardless of who is found to be at fault for the accident. This means that even if you were at fault for the accident, you may still be able to receive benefits from your PIP coverage.

PIP coverage typically includes medical expenses, lost wages, and other related expenses such as childcare costs, housekeeping expenses, and funeral expenses. Depending on the policy, PIP may also cover rehabilitation expenses, such as physical therapy or occupational therapy.

How Does PIP Work?

When you purchase a car insurance policy that includes PIP coverage, you will typically select a coverage limit. This coverage limit represents the maximum amount that your insurance company will pay out for medical expenses, lost wages, and other related expenses. If you are involved in an accident and incur expenses that are covered by your PIP policy, you will need to file a claim with your insurance company to receive benefits.

In most cases, your insurance company will pay out benefits directly to you or to the healthcare provider or other service provider who provided the services. Depending on the policy, you may be required to pay a deductible or co-pay before your benefits kick in.

Benefits of PIP Coverage

There are several benefits to having PIP coverage as part of your car insurance policy. Firstly, PIP can help cover medical expenses that may not be covered by your health insurance policy. Secondly, PIP can help cover lost wages if you are unable to work due to injuries sustained in a car accident. Finally, PIP can help cover other related expenses such as childcare costs and housekeeping expenses.

Benefits of PIP vs. Health Insurance

One of the key benefits of PIP coverage is that it may cover medical expenses that are not covered by your health insurance policy. For example, if you have a high deductible health insurance policy, you may be responsible for paying a significant portion of your medical expenses out of pocket before your insurance kicks in. PIP coverage can help cover these expenses, which can help reduce your financial burden.

Benefits of PIP vs. Liability Coverage

Liability coverage is another type of car insurance coverage that is required by law in most states. While liability coverage can help cover damages that you are responsible for in an accident, it does not cover your own medical expenses or lost wages. PIP coverage can help fill this gap in coverage, providing additional protection for you and your passengers.

Conclusion

Personal Injury Protection (PIP) is a type of car insurance coverage that can provide valuable protection in the event of an accident. PIP can help cover medical expenses, lost wages, and other related expenses that may result from a car accident, regardless of who is found to be at fault. If you are interested in adding PIP coverage to your car insurance policy, speak to your insurance agent to learn more about your options.

Frequently Asked Questions

Personal Injury Protection is a type of car insurance coverage that is mandatory in some states in the United States. It provides coverage for medical expenses and lost wages in case of an accident, regardless of who was at fault. Here are some common questions and answers related to Personal Injury Protection:

What does Personal Injury Protection cover?

Personal Injury Protection, or PIP, covers medical expenses related to injuries sustained in a car accident, including hospital bills, doctor’s visits, and rehabilitation. It also covers lost wages and other expenses related to the accident, such as childcare and housekeeping services. PIP coverage varies by state, so it’s important to check your policy to see what it includes.

Additionally, PIP coverage can also cover funeral expenses and survivor benefits in case of a fatal accident.

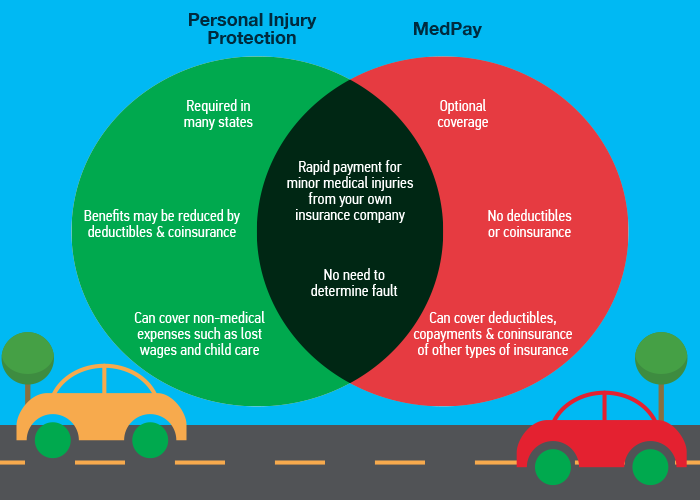

Is Personal Injury Protection the same as Medical Payments coverage?

No, Personal Injury Protection and Medical Payments coverage are not the same. While both cover medical expenses related to a car accident, PIP also covers lost wages and other expenses, whereas Medical Payments only covers medical expenses. PIP is also mandatory in some states, while Medical Payments is optional.

It’s important to check your policy to see what type of coverage you have and what it includes.

Do I need Personal Injury Protection if I have health insurance?

Having health insurance does not replace the need for Personal Injury Protection. PIP provides coverage for medical expenses and lost wages regardless of who was at fault in the accident, while health insurance may not cover all the expenses related to a car accident. Additionally, PIP can cover other expenses, such as childcare and housekeeping services, that health insurance does not cover.

However, if you live in a state where PIP is optional and you have good health insurance, you may choose to opt out of PIP coverage.

Is Personal Injury Protection required in all states?

No, Personal Injury Protection is not required in all states. It is mandatory in some states, such as Florida and Hawaii, while it is optional in others. Some states may have different requirements for PIP coverage, such as minimum coverage amounts.

It’s important to check the car insurance requirements in your state to see if PIP coverage is mandatory or optional.

The cost of Personal Injury Protection coverage varies by state and by insurance company. In some states, PIP coverage can be expensive, while in others it may be more affordable. The cost of PIP coverage is typically included in your overall car insurance premium.

If you live in a state where PIP coverage is optional, you may be able to save money on your car insurance premium by choosing not to include PIP coverage in your policy. However, it’s important to weigh the potential cost savings against the risks of not having PIP coverage in case of an accident.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is an essential aspect of car insurance that provides coverage for medical expenses, lost wages, and other related expenses in case of an accident. With PIP coverage, you and your passengers can get the necessary medical attention and financial support to recover from the injuries sustained in an accident.

Having PIP coverage can also save you from costly legal battles and lengthy court proceedings, as it provides a no-fault system that allows you to file a claim with your own insurance company, regardless of who caused the accident. This means that you can get the compensation you need and deserve, without the added stress and hassle of dealing with the other driver’s insurance company.

Ultimately, including PIP coverage in your car insurance policy is a smart and responsible decision that can protect you and your loved ones from the unexpected. So, when shopping for car insurance, make sure to consider PIP coverage and choose a policy that offers comprehensive protection for you and your passengers.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts