A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Personal injury protection, or PIP, is a type of insurance coverage that can be added to your auto insurance policy. It’s designed to cover medical expenses and lost wages if you’re injured in a car accident, regardless of who is at fault.

In many states, PIP coverage is mandatory, while in others it’s optional. But what exactly does it cover? In this article, we’ll take a closer look at PIP insurance and help you understand what it can do for you in the event of an accident.

Personal injury protection (PIP) covers medical expenses, lost wages, and other related expenses resulting from a car accident. It also covers expenses related to rehabilitation and funeral costs. PIP is required in some states and is optional in others. The amount of coverage varies by state and policy. It is important to check your insurance policy to understand the exact coverage you have.

Contents

- What Does Personal Injury Protection Cover?

- Frequently Asked Questions

- What types of expenses does Personal Injury Protection cover?

- Do I need Personal Injury Protection if I have health insurance?

- Does Personal Injury Protection cover passengers in my car?

- Is Personal Injury Protection required by law?

- Is Personal Injury Protection the same as Medical Payments coverage?

- Personal Injury Protection Car Insurance

What Does Personal Injury Protection Cover?

Personal injury protection (PIP) is a type of car insurance coverage that provides medical and other benefits to drivers and passengers who are injured in a car accident. PIP is often required by law in no-fault states, which means that regardless of who is at fault for the accident, each party’s insurance will pay for their own medical expenses and other damages.

Medical Expenses

The primary benefit of PIP is coverage for medical expenses resulting from a car accident. This can include hospital bills, doctor visits, surgeries, and other treatments necessary for recovery. PIP coverage may also cover rehabilitation services, such as physical therapy or chiropractic care.

In addition, PIP can cover expenses related to mental health treatment, including counseling and therapy sessions. This can be especially important for those who experience emotional trauma or anxiety as a result of a car accident.

Lost Wages

If you are unable to work due to injuries sustained in a car accident, PIP may provide coverage for lost wages. This benefit can help to alleviate some of the financial strain that often accompanies a car accident, allowing you to focus on your recovery without worrying about how you will pay your bills.

Funeral Expenses

In the unfortunate event that a car accident results in a fatality, PIP may cover funeral expenses. This can include the cost of the funeral service, burial or cremation, and other related expenses.

Child Care Expenses

If you are unable to care for your children due to injuries sustained in a car accident, PIP may provide coverage for child care expenses. This benefit can help to ensure that your children are well-cared for while you focus on your recovery.

Rehabilitation Expenses

In addition to medical expenses, PIP may also cover rehabilitation expenses, such as physical therapy or occupational therapy. These services can help to improve your overall health and well-being following a car accident.

Travel Expenses

If you are required to travel for medical treatment or other related expenses as a result of a car accident, PIP may provide coverage for these expenses. This can include the cost of transportation, lodging, and meals.

Home Care Expenses

If you require home care services as a result of a car accident, PIP may provide coverage for these expenses. This can include the cost of a home health aide or other related services.

Death Benefits

If a car accident results in a fatality, PIP may provide death benefits to the surviving family members. This can include a lump sum payment or ongoing payments to help cover expenses and provide financial support.

Benefits of PIP

One of the main benefits of PIP is that it provides coverage regardless of who is at fault for the accident. This can help to streamline the claims process and ensure that you receive the benefits you need to recover from your injuries.

In addition, PIP coverage can be customized to meet your specific needs and budget. You can choose the amount of coverage you need, as well as any additional benefits that may be relevant to your situation.

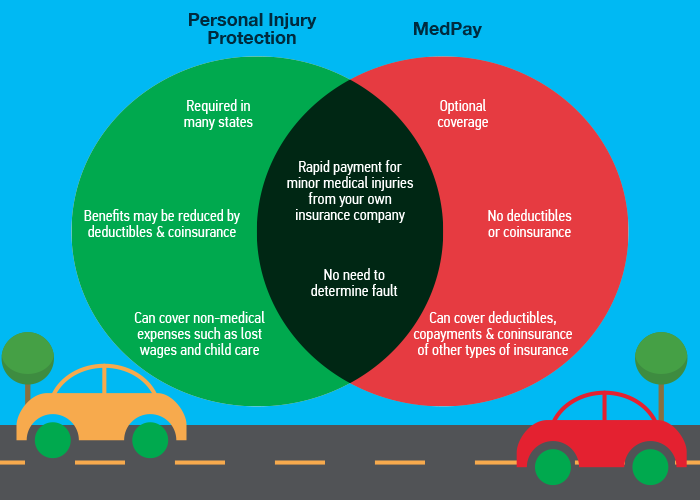

PIP vs. Medical Payments Coverage

While PIP and medical payments coverage are both designed to provide medical benefits following a car accident, there are some key differences between the two.

Medical payments coverage is typically an add-on to your auto insurance policy, and provides coverage for medical expenses only. PIP, on the other hand, provides a broader range of benefits, including lost wages, funeral expenses, and rehabilitation expenses.

In addition, PIP is required by law in certain states, while medical payments coverage is optional. It’s important to check your state’s requirements and regulations to determine which type of coverage is right for you.

Conclusion

Personal injury protection can provide valuable coverage in the event of a car accident, helping to cover medical expenses, lost wages, and other related expenses. By understanding what PIP covers and how it works, you can make an informed decision about your auto insurance coverage and ensure that you are protected in the event of an accident.

Frequently Asked Questions

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. Here are some common questions and answers about PIP coverage.

What types of expenses does Personal Injury Protection cover?

Personal Injury Protection typically covers medical expenses, lost wages, and other related expenses. This can include hospital bills, doctor’s visits, physical therapy, and other medical treatments. PIP can also cover lost wages if you are unable to work due to your injuries, as well as other expenses like childcare or housekeeping services that you may need while you recover.

It’s important to note that PIP coverage varies by state, so it’s a good idea to check with your insurance company to see exactly what is covered under your policy.

Do I need Personal Injury Protection if I have health insurance?

Even if you have health insurance, Personal Injury Protection can be a valuable addition to your car insurance policy. Health insurance may not cover all of your medical expenses after a car accident, and it typically doesn’t cover lost wages or other related expenses. PIP can provide additional coverage for these expenses, giving you peace of mind and financial protection in case of an accident.

Additionally, PIP coverage is usually no-fault, which means that it applies regardless of who is at fault for the accident. This can be especially important if you live in a state with no-fault insurance laws.

Does Personal Injury Protection cover passengers in my car?

Yes, Personal Injury Protection typically covers passengers in your car who are injured in an accident. This can include family members, friends, or other passengers who were riding in your car at the time of the accident. PIP can cover their medical expenses, lost wages, and other related expenses, regardless of who was at fault for the accident.

It’s important to note that PIP coverage varies by state, so it’s a good idea to check with your insurance company to see exactly what is covered under your policy and how it applies to passengers in your car.

Is Personal Injury Protection required by law?

Personal Injury Protection is required by law in some states, while it is optional in others. In states where it is required, drivers are typically required to carry a minimum amount of PIP coverage as part of their car insurance policy.

Even in states where PIP is not required by law, it can still be a valuable addition to your car insurance policy. PIP coverage can provide additional financial protection in case of an accident, and it can help cover expenses that may not be covered by your health insurance or other types of car insurance coverage.

Is Personal Injury Protection the same as Medical Payments coverage?

Personal Injury Protection and Medical Payments coverage are similar in that they both cover medical expenses after a car accident. However, there are some key differences between the two types of coverage.

Personal Injury Protection typically covers a wider range of expenses than Medical Payments coverage, including lost wages and other related expenses. PIP coverage is also usually no-fault, which means that it applies regardless of who is at fault for the accident.

Medical Payments coverage, on the other hand, only covers medical expenses, and it is typically fault-based, which means that it only applies if the driver who caused the accident is found to be at fault.

Personal Injury Protection Car Insurance

In conclusion, personal injury protection (PIP) is a type of car insurance coverage that can provide financial protection for you and your passengers in the event of an accident. It covers a wide range of expenses, including medical bills, lost wages, and even funeral costs.

While PIP is not mandatory in all states, it can be a valuable addition to your car insurance policy. It can offer peace of mind knowing that you and your loved ones are protected in case of an accident.

If you’re interested in adding PIP to your car insurance coverage, it’s important to review your policy carefully and talk to your insurance agent to ensure that you have the coverage you need. With PIP in place, you can feel confident knowing that you’re prepared for any unexpected accidents that may occur on the road.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts