A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Slip and fall accidents can happen to anyone, anywhere, and at any time. It’s a common type of personal injury case that can result in serious injuries and financial losses. But when it comes to tax implications, things can become a bit confusing. Are slip and fall cases taxable? Let’s find out in this informative article.

While slip and fall accidents can be physically and emotionally taxing, the last thing anyone wants is to be hit with a hefty tax bill. However, the taxability of such cases depends on various factors, such as the nature of the settlement, the type of damages awarded, and the tax laws of the state. In this article, we’ll explore the tax implications of slip and fall cases to give you a clear understanding of what to expect.

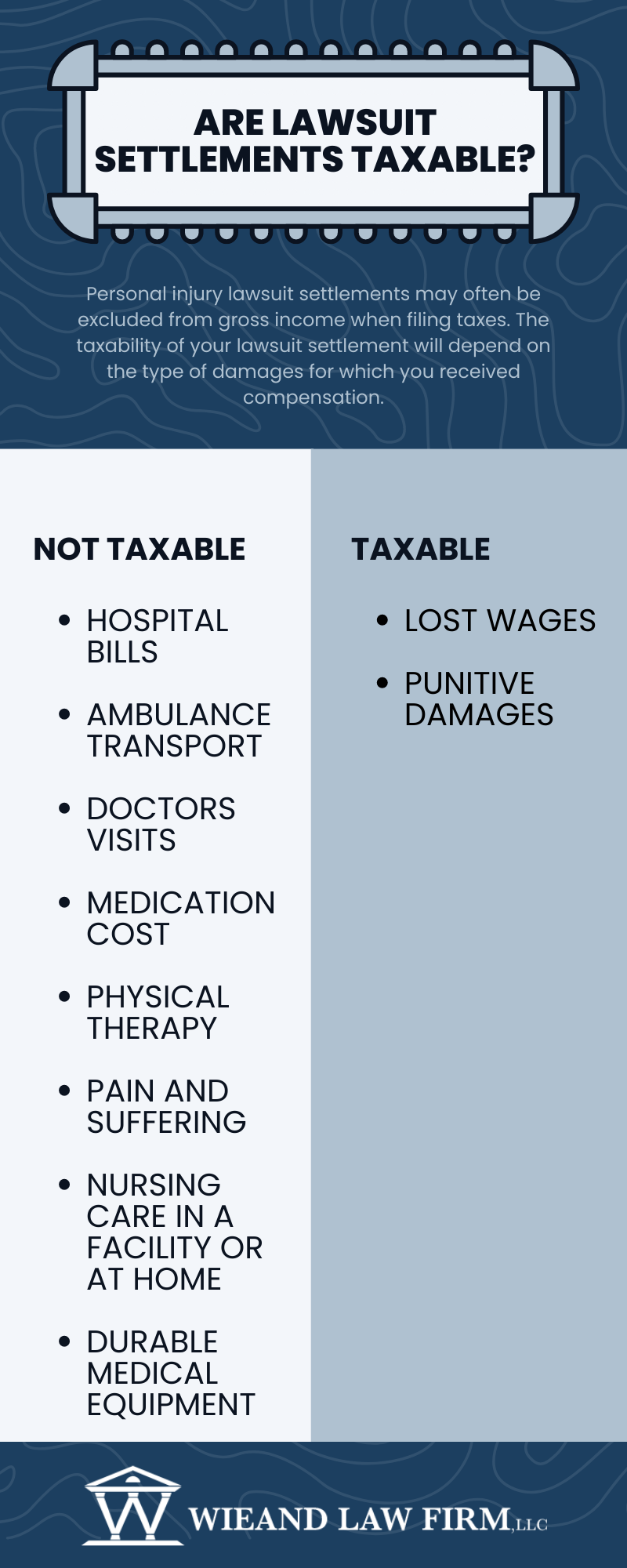

Slip and fall cases can be taxable depending on the circumstances. If the settlement or award includes compensation for lost wages or medical expenses, those portions may be taxable. However, if the settlement or award is solely for pain and suffering, it may be tax-free. It’s important to consult with a tax professional to determine the tax implications of your specific situation.

Is Slip and Fall Cases Taxable?

Slip and fall cases can be a bit confusing when it comes to taxes. If you’ve received a settlement or award from a slip and fall case, you may be wondering if it’s taxable. The answer is not straightforward, as it depends on several factors. In this article, we’ll explore whether slip and fall cases are taxable and what factors can impact the taxability of your settlement or award.

What is a Slip and Fall Case?

A slip and fall case is a type of personal injury case that arises when a person slips, trips, or falls due to a dangerous condition on someone else’s property. Slip and fall cases can occur in a variety of settings, such as grocery stores, parking lots, or private residences. In order to have a valid slip and fall case, the injured person must prove that the property owner was negligent in maintaining the property and that their negligence caused the injury.

General Tax Rules for Settlements and Awards

When it comes to taxes, settlements and awards are generally considered taxable income. This means that if you receive a settlement or award, you may need to report it on your tax return and pay taxes on it. However, there are some exceptions to this rule, such as if the settlement or award is for physical injury or sickness.

Physical Injury or Sickness Exception

If your slip and fall case settlement or award is for physical injury or sickness, it may be exempt from taxes. The IRS considers compensation for physical injury or sickness to be non-taxable. This means that if your slip and fall case caused physical injury or sickness, you may not have to pay taxes on your settlement or award.

Emotional Distress Exception

If your slip and fall case settlement or award is for emotional distress, it may be taxable. Emotional distress settlements and awards are generally taxable unless they are related to a physical injury or sickness. This means that if your slip and fall case caused emotional distress but not physical injury or sickness, you may have to pay taxes on your settlement or award.

Punitive Damages

If your slip and fall case settlement or award includes punitive damages, they are generally taxable. Punitive damages are intended to punish the defendant for their behavior and are not related to compensation for physical injury or sickness. This means that if your settlement or award includes punitive damages, you will likely have to pay taxes on them.

Tax Planning for Slip and Fall Cases

If you’re involved in a slip and fall case, it’s important to consider tax implications when negotiating a settlement or award. For example, if you’re negotiating a settlement, you may want to structure it so that it includes compensation for physical injury or sickness, which is non-taxable. You may also want to consult with a tax professional to determine the tax implications of any settlement or award you receive.

Benefits of Consulting with a Tax Professional

Consulting with a tax professional can be beneficial when it comes to slip and fall cases. A tax professional can help you understand the tax implications of any settlement or award you receive and help you plan accordingly. They can also help you determine whether you qualify for any exemptions or deductions related to your slip and fall case.

Slip and Fall Cases vs. Other Personal Injury Cases

Slip and fall cases are similar to other personal injury cases in that they involve compensation for injuries caused by someone else’s negligence. However, the tax implications of slip and fall cases can be different than other personal injury cases. For example, slip and fall cases are more likely to involve emotional distress claims, which may be taxable.

Conclusion

In conclusion, slip and fall cases can be taxable, depending on several factors. If your settlement or award is for physical injury or sickness, it may be exempt from taxes. However, if your settlement or award is for emotional distress or includes punitive damages, it is likely taxable. It’s important to consult with a tax professional to understand the tax implications of any settlement or award you receive. By planning ahead, you can minimize the tax impact of your slip and fall case settlement or award.

Frequently Asked Questions

Slip and fall accidents can be a common occurrence in everyday life. If you have been injured in a slip and fall accident, you may be wondering whether any compensation you receive is taxable. Here are some common questions and answers regarding the taxability of slip and fall cases:

Q1. Is compensation received from a slip and fall case taxable?

Generally, compensation received from a slip and fall case is not taxable. This is because such compensation is considered to be a payment for physical injuries or sickness and is therefore not included in your gross income.

However, there are some exceptions. For instance, if a portion of the compensation is for lost wages, that portion may be taxable. Additionally, if you claimed a deduction for medical expenses related to the injury in a prior year, any compensation received for those expenses may be taxable.

Q2. What if the compensation includes interest?

If the compensation received includes interest, the interest portion is generally taxable. This is because interest is considered to be income and is therefore subject to taxation.

It is important to note that if the compensation includes both a non-taxable portion for physical injuries and a taxable portion for interest, the two portions must be reported separately on your tax return.

Q3. Are punitive damages received from a slip and fall case taxable?

Punitive damages are intended to punish the defendant for their actions, rather than compensate the plaintiff for their injuries. As such, punitive damages are generally considered to be taxable income.

It is important to note that if the compensation includes both non-taxable compensatory damages and taxable punitive damages, the two portions must be reported separately on your tax return.

Q4. What if the compensation is received over multiple years?

If the compensation is received over multiple years, it is important to determine the taxability of each portion of the compensation based on the year in which it was received. For example, if a portion of the compensation is received in one tax year and another portion is received in a subsequent tax year, the taxability of each portion will depend on the specific tax laws in effect for each year.

It may be helpful to consult a tax professional to ensure that the compensation is properly reported on your tax returns.

Q5. What if the slip and fall case is settled out of court?

If the slip and fall case is settled out of court, the taxability of the compensation will depend on the specific terms of the settlement agreement. Generally, if the settlement is for physical injuries or sickness, the compensation will not be taxable.

It is important to review the settlement agreement carefully and consult a tax professional if you have any questions about the taxability of the compensation received.

In conclusion, the answer to whether slip and fall cases are taxable is not a straightforward one. It largely depends on the nature of the settlement received. If the settlement is meant to compensate for physical injuries or medical expenses, then it is likely not taxable. However, if the settlement is meant to compensate for lost wages or punitive damages, then it may be subject to taxation.

It is important to consult with a tax professional to understand the tax implications of a slip and fall settlement. This way, you can make informed decisions and avoid any surprises come tax season. Additionally, it is important to keep thorough records of all expenses related to the slip and fall incident, as these can be used to reduce the taxable amount of any settlement received.

Overall, slip and fall cases can be complex, and it is important to seek legal and financial advice to ensure that you are protected and that your rights are upheld. By understanding the tax implications of a settlement, you can make informed decisions and ensure that you receive the compensation you deserve.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts