A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Rhode Island is a state with a rich history, diverse culture, and scenic beauty. However, accidents can happen anywhere, and when they do, they can have serious consequences. Personal injury protection is a type of insurance that can help mitigate those consequences, but is it required in Rhode Island?

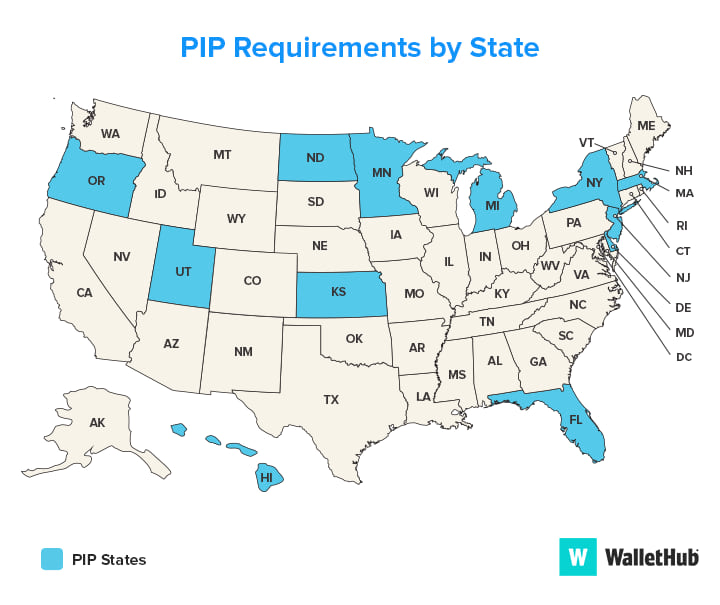

If you’re a driver in Rhode Island, it’s essential to understand the state’s auto insurance requirements. Personal injury protection is not required in Rhode Island, but it is an option that drivers can choose to add to their policy. In this article, we’ll explore what personal injury protection is, how it works, and whether or not it’s a good idea to include it in your auto insurance coverage.

Yes, Personal Injury Protection (PIP) is required in Rhode Island. It is mandatory for all vehicles registered in the state to have a minimum coverage of $25,000 per person for bodily injury caused by an accident. PIP covers medical expenses and lost wages for the driver and passengers, regardless of who is at fault for the accident.

Is Personal Injury Protection Required in Rhode Island?

If you are a driver in Rhode Island, you may be wondering whether you are required to have Personal Injury Protection (PIP) coverage as part of your auto insurance policy. PIP is a type of insurance that covers medical expenses and lost wages for you and your passengers if you are injured in a car accident, regardless of who is at fault. In this article, we will explore the requirements for PIP coverage in Rhode Island and the benefits of having this coverage.

What is Personal Injury Protection?

Personal Injury Protection, or PIP, is a type of insurance that covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. PIP is designed to provide coverage regardless of who is at fault for the accident. In Rhode Island, PIP coverage is also known as “no-fault” coverage.

Benefits of PIP Coverage

There are several benefits to having PIP coverage as part of your auto insurance policy. These benefits include:

- Medical Expenses: PIP coverage can help pay for medical expenses related to injuries sustained in a car accident, such as ambulance rides, hospital stays, and rehabilitation.

- Lost Wages: PIP coverage can also help replace lost wages if you are unable to work due to injuries sustained in a car accident.

- Funeral Expenses: In the event that a passenger is killed in a car accident, PIP coverage can help pay for funeral expenses.

- Legal Expenses: PIP coverage can also help cover legal expenses if you are sued as a result of a car accident.

PIP Coverage vs. Liability Coverage

It’s important to note that PIP coverage is different from liability coverage, which is required in Rhode Island. Liability coverage helps pay for damages and injuries that you may cause to others in a car accident. PIP coverage, on the other hand, provides coverage for you and your passengers regardless of who is at fault for the accident.

Is PIP Coverage Required in Rhode Island?

Rhode Island law requires that all drivers carry liability insurance as well as uninsured motorist coverage. However, PIP coverage is not required in Rhode Island. While PIP coverage is not mandatory, it can be a valuable addition to your auto insurance policy.

Benefits of Adding PIP Coverage to Your Policy

While PIP coverage is not required in Rhode Island, adding this coverage to your auto insurance policy can provide valuable protection in the event of a car accident. Some benefits of adding PIP coverage to your policy include:

- Peace of Mind: Knowing that you and your passengers are covered in the event of a car accident can provide peace of mind while driving.

- Protection for Passengers: PIP coverage can provide coverage for your passengers, who may not have their own health insurance or PIP coverage.

- Additional Coverage: PIP coverage can provide additional coverage beyond what is offered by your health insurance policy.

How Much PIP Coverage Should You Have?

The amount of PIP coverage that you should have depends on your individual needs and budget. Rhode Island law requires that all insurance policies offer a minimum of $2,000 in PIP coverage. However, you can choose to purchase more coverage if you feel that it is necessary.

Conclusion

While PIP coverage is not required in Rhode Island, it can provide valuable protection in the event of a car accident. Adding PIP coverage to your auto insurance policy can provide peace of mind and additional coverage for you and your passengers. If you have questions about PIP coverage or would like to add this coverage to your policy, contact your insurance provider.

Frequently Asked Questions

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance coverage that helps pay for medical expenses and lost wages if you are injured in a car accident. PIP coverage is also known as “no-fault” insurance because it pays out regardless of who caused the accident.

In Rhode Island, PIP coverage is required by law. All drivers must carry a minimum of $25,000 in PIP coverage per person, per accident.

What does PIP cover?

PIP coverage can help pay for a variety of expenses related to a car accident, including medical expenses, lost wages, and funeral expenses. PIP can also cover expenses related to rehabilitation, such as physical therapy or occupational therapy.

In Rhode Island, PIP coverage is required to include at least $8,000 in medical expenses and $1,000 in lost wages per person, per accident.

Who is covered by PIP?

PIP coverage typically extends to the policyholder and any passengers in their car at the time of the accident. PIP coverage may also cover the policyholder if they are a pedestrian or cyclist and are struck by a vehicle.

In Rhode Island, PIP coverage is required to cover all passengers in the policyholder’s car, regardless of who was at fault for the accident.

What happens if I don’t have PIP coverage?

If you are caught driving without the required PIP coverage in Rhode Island, you may face fines and other penalties. Additionally, if you are injured in a car accident and do not have PIP coverage, you may be responsible for paying your own medical bills and lost wages.

It is important to make sure you have the required PIP coverage and that you understand your insurance policy to avoid any potential legal or financial consequences.

Can I choose not to have PIP coverage?

No, in Rhode Island, PIP coverage is required by law. However, you may be able to choose the amount of PIP coverage you carry, as long as it meets the state’s minimum requirements.

It is important to note that while PIP coverage may increase your insurance premiums, it can also provide important financial protection in the event of a car accident.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is required in Rhode Island. This means that all drivers must carry a minimum of $25,000 in PIP coverage. While this may seem like an added expense, PIP can be a valuable asset if you are ever involved in an accident. Not only does it provide coverage for medical expenses, but it can also help with lost wages and other expenses related to the accident. So, while it may be tempting to opt out of PIP coverage, it is important to consider the potential benefits it can offer in the event of an accident.

Furthermore, PIP coverage can also help protect you from potential legal action. Without PIP coverage, you may be held liable for damages and expenses related to an accident. This can be a costly and stressful situation to find yourself in. By carrying PIP coverage, you can protect yourself from the financial and legal consequences of an accident.

Overall, while PIP coverage may be required in Rhode Island, it is ultimately up to you to decide how much coverage you need. However, by taking the time to understand the potential benefits of PIP coverage, you can make an informed decision that will safeguard you and your loved ones in the event of an accident.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts