A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Personal injury protection (PIP) is a type of car insurance that helps cover medical expenses and lost wages in the event of an accident. While some states require drivers to carry PIP coverage, the laws vary by location. If you’re a driver in New Mexico, you may be wondering if PIP is required. Here’s what you need to know.

New Mexico is one of several states that does not require drivers to carry PIP insurance. However, it’s still a good idea to consider adding this coverage to your policy. In the event of an accident, PIP can help cover medical expenses and lost wages, regardless of who is at fault. So, is PIP required in New Mexico? Read on to learn more.

Yes, Personal Injury Protection (PIP) is required in New Mexico as part of the state’s mandatory auto insurance requirements. PIP coverage provides medical expenses and lost wages coverage for you and your passengers in the event of an accident, regardless of who was at fault. The minimum required PIP coverage in New Mexico is $4,500 per person, per accident.

Is Personal Injury Protection Required in New Mexico?

If you’re a driver in New Mexico, you may be wondering if personal injury protection (PIP) is required by law. PIP is a type of car insurance that covers medical expenses and lost wages for you and your passengers after an accident, regardless of who is at fault. In this article, we’ll explore whether PIP is mandatory in New Mexico and what you need to know about this type of coverage.

What is Personal Injury Protection?

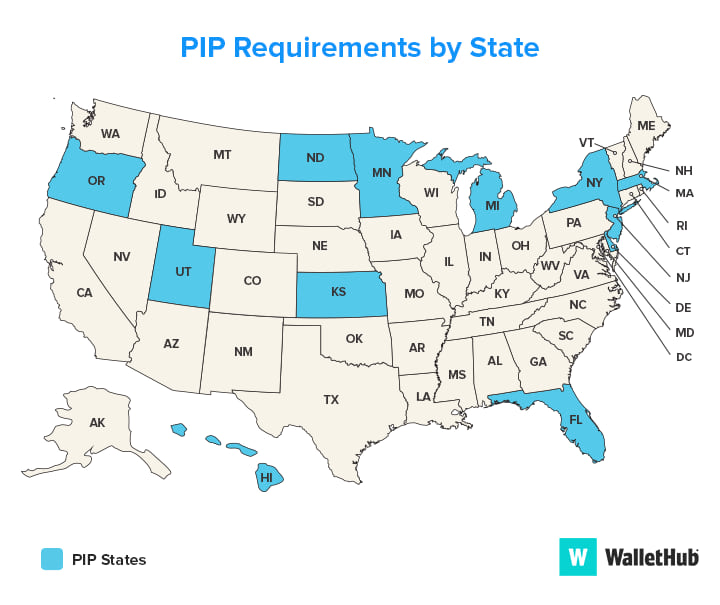

Personal injury protection, also known as no-fault insurance, is a type of car insurance that covers medical expenses and lost wages for you and your passengers after a car accident. PIP is designed to provide prompt payment of medical expenses and lost wages without the need to determine who was at fault for the accident. This type of coverage is mandatory in some states, but not in others.

In New Mexico, PIP is not mandatory, but it is offered as an option by most car insurance companies. If you choose to purchase PIP coverage, it can provide valuable protection in the event of an accident.

What Does Personal Injury Protection Cover?

Personal injury protection typically covers the following expenses:

- Medical expenses: This includes hospital bills, doctor’s visits, and other medical costs related to the accident.

- Lost wages: If you are unable to work due to injuries sustained in the accident, PIP can provide compensation for lost wages.

- Funeral expenses: If a passenger in your car is killed in an accident, PIP can cover funeral expenses.

- Child care expenses: If you are unable to care for your children due to injuries sustained in the accident, PIP can cover child care expenses.

It’s important to note that PIP only covers medical expenses and lost wages up to the policy limit. If your expenses exceed the policy limit, you may be responsible for paying the difference out of pocket.

Benefits of Personal Injury Protection

There are several benefits to purchasing personal injury protection, even if it’s not required by law:

- Peace of mind: Knowing that you and your passengers are covered in the event of an accident can provide peace of mind.

- Quick payment: PIP is designed to provide prompt payment of medical expenses and lost wages without the need to determine who was at fault for the accident.

- No deductibles: PIP typically has no deductible, which means you won’t have to pay anything out of pocket before your coverage kicks in.

- Additional coverage: PIP can provide additional coverage beyond what is covered by your health insurance or disability insurance.

PIP vs. Bodily Injury Liability

Bodily injury liability is another type of car insurance that covers medical expenses and lost wages for other people if you are at fault for an accident. While PIP covers you and your passengers regardless of who is at fault, bodily injury liability only covers other people. It’s important to note that bodily injury liability is mandatory in New Mexico.

If you’re trying to decide between PIP and bodily injury liability, it’s important to consider your individual needs and circumstances. PIP can provide valuable protection for you and your passengers, while bodily injury liability can protect you from financial liability if you are at fault for an accident.

Conclusion

While personal injury protection is not mandatory in New Mexico, it can provide valuable protection in the event of an accident. PIP covers medical expenses and lost wages for you and your passengers, regardless of who is at fault. If you’re considering purchasing PIP coverage, it’s important to understand what it covers and how much protection it provides.

Ultimately, the decision to purchase PIP coverage or not is up to you. Consider your individual needs and circumstances, and talk to your insurance company to determine what type of coverage is right for you.

Frequently Asked Questions

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of an accident. PIP is designed to provide coverage regardless of who is at fault for the accident.

In New Mexico, PIP coverage is optional. However, it is highly recommended that drivers add PIP to their insurance policy to ensure they are fully covered in the event of an accident.

What does PIP cover?

PIP covers medical expenses, lost wages, and other related expenses in the event of an accident. Medical expenses can include hospital bills, doctor’s visits, and rehabilitation services. Lost wages can include time off work due to injury or disability.

In New Mexico, PIP coverage typically ranges from $2,500 to $25,000 per person, per accident. It is important to note that PIP coverage does not cover property damage, which is typically covered under a separate insurance policy.

How does PIP differ from other types of car insurance?

Unlike liability insurance, which covers damages and injuries that you cause to others, PIP is designed to cover your own medical expenses and lost wages in the event of an accident. PIP is also different from collision insurance, which covers damages to your own vehicle in the event of an accident.

In New Mexico, PIP coverage is optional, while liability and collision insurance are required by law. However, adding PIP to your insurance policy can provide additional protection and peace of mind.

Does my health insurance cover the same expenses as PIP?

While health insurance can cover some medical expenses related to an accident, it may not cover all of the costs associated with an accident. PIP is specifically designed to cover medical expenses and lost wages related to a car accident, regardless of who is at fault.

In New Mexico, PIP coverage is optional, but it is highly recommended that drivers add PIP to their insurance policy to ensure they are fully covered in the event of an accident.

What happens if I don’t have PIP coverage?

If you are involved in an accident and do not have PIP coverage, you may be responsible for paying your own medical expenses and lost wages. This can be a significant financial burden, especially if you are unable to work due to your injuries.

In New Mexico, PIP coverage is optional, but it is highly recommended that drivers add PIP to their insurance policy to ensure they are fully covered in the event of an accident.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection, or PIP, is not required in New Mexico. However, it is highly recommended that drivers consider adding this coverage to their auto insurance policy. PIP can provide invaluable financial support in the event of an accident, covering medical expenses, lost wages, and other related costs.

While it is not mandatory, PIP can be a valuable tool to protect yourself and your family from the financial burden of an accident. In a state like New Mexico, which has high rates of uninsured drivers, having PIP can provide added peace of mind when you’re on the road.

Ultimately, the decision to add PIP to your auto insurance policy is a personal one. It’s important to weigh the potential benefits against the added cost, and to consider your own financial situation and risk tolerance. But for many drivers in New Mexico, PIP can be a smart investment that helps ensure their financial stability in the event of an accident.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts