A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Illinois is a state where driving is a necessity, but accidents can happen at any time. With an increasing number of cars on the road, it’s important to ensure that you have adequate insurance coverage, including Personal Injury Protection (PIP). But the question remains, is PIP required in Illinois?

Personal Injury Protection (PIP) is not mandatory in Illinois, but it is strongly recommended. PIP provides coverage for medical expenses, lost wages, and other related expenses in the event of an accident. Understanding the benefits of PIP and whether or not it is right for you can help you make an informed decision about your coverage options. So, let’s dive in and explore the world of PIP insurance in Illinois.

Yes, Personal Injury Protection (PIP) is required in Illinois. PIP coverage provides benefits for medical expenses, lost wages, and other related expenses if you’re injured in a car accident, regardless of who is at fault. The minimum coverage required in Illinois is $20,000 per person per accident for medical expenses and $20,000 per person per accident for lost income. It’s important to note that PIP coverage is not required for motorcycles in Illinois.

Contents

- Is Personal Injury Protection Required in Illinois?

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) in Illinois?

- What does Personal Injury Protection (PIP) cover in Illinois?

- Is Personal Injury Protection (PIP) required in Illinois?

- What are the benefits of adding Personal Injury Protection (PIP) to my Illinois auto insurance policy?

- How much does Personal Injury Protection (PIP) cost in Illinois?

- What is Personal Injury Protection (PIP)?

Is Personal Injury Protection Required in Illinois?

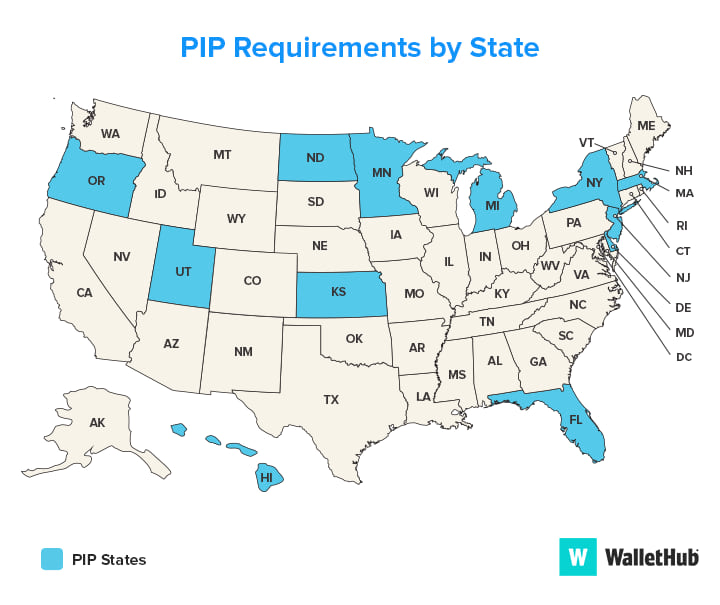

Illinois is one of the few states that does not require Personal Injury Protection (PIP) coverage in its auto insurance policies. However, this does not mean that drivers in Illinois should overlook this type of coverage. In this article, we will explore the ins and outs of PIP coverage and why it may be beneficial to drivers in Illinois.

What is Personal Injury Protection?

Personal Injury Protection, or PIP, is a type of coverage that provides medical and lost wage benefits to the driver and passengers in the event of an accident, regardless of who is at fault. PIP coverage is often referred to as “no-fault” coverage, as it is designed to pay out benefits regardless of who caused the accident.

Benefits of PIP Coverage

One of the main benefits of PIP coverage is that it provides immediate medical benefits to the driver and passengers in the event of an accident. This can be particularly beneficial if the driver or passengers do not have health insurance. PIP coverage can also provide lost wage benefits if the driver or passengers are unable to work due to injuries sustained in the accident.

Another benefit of PIP coverage is that it can help cover the costs of medical expenses that may not be covered by health insurance, such as deductibles and co-pays. PIP coverage can also help cover the costs of rehabilitation services, such as physical therapy, that may be necessary after an accident.

PIP vs. Liability Coverage

It is important to note that PIP coverage is different from liability coverage. Liability coverage is required in Illinois and covers damages that the driver may cause to others in an accident. PIP coverage, on the other hand, covers medical and lost wage benefits for the driver and passengers in the insured vehicle.

Table: PIP Coverage vs. Liability Coverage

| PIP Coverage | Liability Coverage |

|---|---|

| Provides medical and lost wage benefits to the driver and passengers in the insured vehicle, regardless of who is at fault | Covers damages that the driver may cause to others in an accident |

| Does not cover damages to other vehicles or property | Covers damages to other vehicles or property |

Is PIP Coverage Required in Illinois?

No, PIP coverage is not required in Illinois. However, drivers in Illinois can choose to add PIP coverage to their auto insurance policies if they wish to have this type of coverage.

Pros and Cons of Adding PIP Coverage

One of the main pros of adding PIP coverage to an auto insurance policy is that it can provide additional medical and lost wage benefits to the driver and passengers in the event of an accident. This can be particularly beneficial if the driver or passengers do not have health insurance.

However, adding PIP coverage to an auto insurance policy can also increase the overall cost of the policy. Drivers in Illinois should weigh the pros and cons of adding PIP coverage before making a decision.

Conclusion

Although PIP coverage is not required in Illinois, it may be beneficial for drivers to add this type of coverage to their auto insurance policies. PIP coverage can provide immediate medical and lost wage benefits to the driver and passengers in the event of an accident, regardless of who is at fault. Drivers in Illinois should consider their options and speak with their insurance agent to determine if PIP coverage is right for them.

Frequently Asked Questions

What is Personal Injury Protection (PIP) in Illinois?

Personal Injury Protection (PIP) is an optional coverage that can be added to an auto insurance policy in Illinois. It covers medical expenses, lost wages, and other damages regardless of who was at fault in an accident.

What does Personal Injury Protection (PIP) cover in Illinois?

In Illinois, Personal Injury Protection (PIP) covers medical expenses, lost wages, and other damages resulting from a car accident. It can also cover expenses related to household services, such as cleaning and yard work, if the accident caused the injured person to be unable to perform those tasks.

Is Personal Injury Protection (PIP) required in Illinois?

No, Personal Injury Protection (PIP) is not required in Illinois. However, it is an optional coverage that can provide additional protection for drivers and passengers in the event of an accident.

What are the benefits of adding Personal Injury Protection (PIP) to my Illinois auto insurance policy?

Adding Personal Injury Protection (PIP) to your Illinois auto insurance policy can provide additional coverage for medical expenses, lost wages, and other damages that may not be fully covered by other insurance policies. It can also provide peace of mind knowing that you and your passengers are protected in the event of an accident.

How much does Personal Injury Protection (PIP) cost in Illinois?

The cost of Personal Injury Protection (PIP) varies depending on several factors, including the insurance provider, the level of coverage, and the driver’s history. It is important to shop around and compare quotes from different insurance companies to find the best coverage at an affordable price.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) may not be required in Illinois, but it is highly recommended. PIP can provide crucial coverage for medical expenses, lost wages and other costs related to an accident, regardless of who was at fault. Without PIP, accident victims may be left with significant financial burdens.

While PIP may increase the cost of car insurance premiums, the benefits of having this coverage far outweigh the costs. In the event of an accident, PIP can provide peace of mind and financial protection for drivers and passengers alike.

Ultimately, the decision to purchase PIP is up to each individual driver. However, it is important to carefully consider the potential risks and benefits before making a decision. By weighing the costs and benefits, drivers can make an informed decision that will protect themselves and their families in the event of an accident.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts