A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Idaho is a state that values safety and security, especially when it comes to its drivers. One question that often arises in conversations about car insurance is whether or not personal injury protection is required in Idaho.

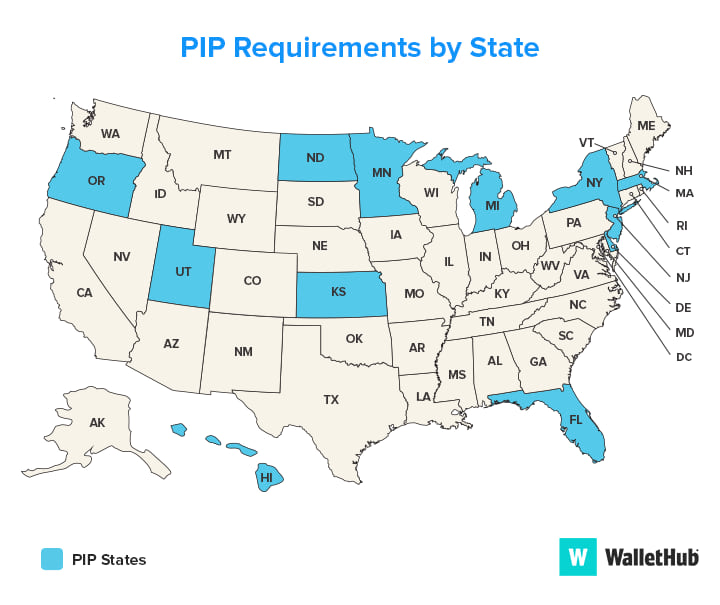

Personal injury protection, or PIP, is a type of car insurance coverage that helps to pay for medical expenses and lost wages in the event of an accident. While some states require drivers to have PIP coverage, Idaho is not one of them. However, that doesn’t mean that PIP isn’t an important type of insurance to consider.

Yes, Personal Injury Protection (PIP) is required in Idaho. Drivers must carry a minimum of $5,000 in PIP coverage in order to operate a vehicle in the state. PIP helps cover medical expenses and lost wages for the driver and their passengers in the event of an accident. It is important to note that PIP coverage is considered “no-fault” insurance, meaning it pays out regardless of who is deemed at fault for the accident.

Is Personal Injury Protection Required in Idaho?

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance coverage that provides benefits for medical expenses, lost wages, and other related expenses in the event of an accident. PIP is known as “no-fault” insurance because it provides benefits regardless of who is at fault for the accident. PIP is also sometimes referred to as “medical payments” coverage.

In Idaho, PIP is not required by law. However, it is an optional coverage that can be added to your car insurance policy. If you choose to add PIP to your policy, it can provide valuable benefits in the event of an accident.

Benefits of Personal Injury Protection

Adding PIP to your car insurance policy can provide several benefits. These benefits can include:

1. Medical Expenses Coverage: PIP can provide coverage for medical expenses related to an accident, including hospital bills, doctor visits, and other medical costs.

2. Lost Wages Coverage: If you are unable to work due to injuries sustained in an accident, PIP can provide coverage for lost wages.

3. Rehabilitation Costs Coverage: PIP can provide coverage for rehabilitation costs, such as physical therapy, occupational therapy, and other related expenses.

4. Funeral Expenses Coverage: If a person is killed in an accident, PIP can provide coverage for funeral expenses.

PIP vs. Medical Payments Coverage

PIP and Medical Payments coverage are similar types of coverage, but there are some key differences. Medical Payments coverage only provides coverage for medical expenses related to an accident, while PIP provides coverage for medical expenses, lost wages, and other related expenses.

In addition, Medical Payments coverage is not a “no-fault” coverage like PIP. This means that Medical Payments coverage only provides benefits if you are found to be at fault for the accident. PIP, on the other hand, provides benefits regardless of who is at fault.

Conclusion

While PIP is not required by law in Idaho, it can provide valuable benefits in the event of an accident. Adding PIP to your car insurance policy can provide coverage for medical expenses, lost wages, and other related expenses. However, it’s important to note that PIP and Medical Payments coverage are not the same thing, and it’s important to understand the differences between the two types of coverage.

Contents

Frequently Asked Questions

Here are some common questions regarding Personal Injury Protection in Idaho:

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident, regardless of who was at fault for the accident. PIP coverage is also known as “no-fault” insurance because it pays out regardless of who caused the accident.

In Idaho, PIP coverage is optional. However, insurance providers are required to offer it to you when you purchase car insurance.

What does PIP cover?

PIP covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident, regardless of who was at fault for the accident. PIP coverage can also include benefits for things like child care expenses and household services if you are unable to perform those duties due to your injuries.

It’s important to note that PIP coverage has limits, which may vary depending on your policy. You should review your policy carefully to understand what is covered and what the limits are.

Do I need PIP coverage if I have health insurance?

While health insurance may cover some of the medical expenses related to a car accident, it may not cover all of them. PIP coverage can help fill in the gaps and cover expenses like lost wages and household services that health insurance may not cover.

In Idaho, PIP coverage is optional. However, it’s important to consider the potential benefits of having PIP coverage in addition to your health insurance.

How much PIP coverage do I need?

The amount of PIP coverage you need may vary depending on your individual circumstances. When purchasing car insurance in Idaho, insurance providers are required to offer minimum PIP coverage of $5,000. You may choose to purchase additional coverage beyond the minimum required amount.

It’s important to carefully consider your individual circumstances and potential expenses when deciding how much PIP coverage to purchase.

Can I waive PIP coverage in Idaho?

Yes, you can waive PIP coverage in Idaho. However, insurance providers are required to offer it to you when you purchase car insurance. If you choose to waive PIP coverage, you must do so in writing.

It’s important to carefully consider the potential benefits of having PIP coverage before deciding to waive it.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is not required in the state of Idaho. However, it is still a good idea to consider purchasing PIP coverage to protect yourself and your passengers in the event of an accident.

While Idaho does not mandate PIP coverage, the state does require drivers to carry liability insurance. This type of coverage helps cover damages and injuries that you may cause to other drivers or passengers in an accident, but it does not protect you or your passengers.

By purchasing PIP coverage, you can have peace of mind knowing that you and your passengers are covered for medical expenses, lost wages, and other expenses related to an accident. Overall, it is up to each individual driver to determine whether PIP coverage is necessary for their specific needs.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts