A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Hawaii is a beautiful state that is home to some of the most breathtaking natural wonders in the world. But amidst the beauty, accidents can happen, and injuries can occur. That’s why it’s important to know whether Personal Injury Protection (PIP) is required in Hawaii. In this article, we’ll explore the ins and outs of PIP, how it works, and whether it’s mandatory in the Aloha State. So, let’s dive in and find out what you need to know to protect yourself in Hawaii.

Yes, Personal Injury Protection (PIP) is required in Hawaii. It is mandatory for all drivers to have at least $10,000 in PIP coverage to cover medical expenses and lost wages in case of an accident, regardless of who is at fault. Failure to have PIP coverage may result in fines and legal consequences.

Is Personal Injury Protection Required in Hawaii?

What is Personal Injury Protection?

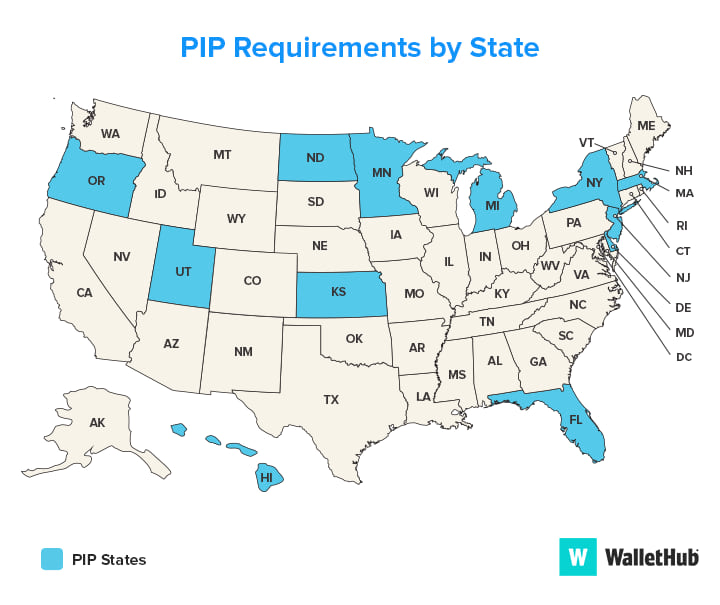

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in case of an accident. It is also known as no-fault insurance because it pays out regardless of who was at fault in the accident. PIP is required in some states, but not in others. So, is Personal Injury Protection required in Hawaii?

Is Personal Injury Protection Required in Hawaii?

Yes, Personal Injury Protection is required in Hawaii. It is a mandatory coverage that must be included in every car insurance policy in the state. The minimum amount of PIP coverage that a driver must have in Hawaii is $10,000.

What Does Personal Injury Protection Cover?

Personal Injury Protection covers medical expenses, lost wages, and other related expenses in case of an accident. It can cover up to $10,000 per person per accident, regardless of who was at fault. Some of the expenses covered by PIP include:

– Medical expenses

– Lost wages

– Rehabilitation expenses

– Funeral expenses

– Childcare expenses

Benefits of Personal Injury Protection

Personal Injury Protection has several benefits for drivers in Hawaii. First and foremost, it ensures that you are protected in case of an accident, regardless of who was at fault. This means that you can get the medical treatment you need without worrying about how you will pay for it.

Additionally, PIP can help cover lost wages if you are unable to work due to your injuries. It can also cover other related expenses, such as rehabilitation and childcare, which can add up quickly.

Personal Injury Protection vs. Bodily Injury Liability

While Personal Injury Protection is required in Hawaii, Bodily Injury Liability is not. Bodily Injury Liability is a type of car insurance that covers the medical expenses and lost wages of other drivers and passengers if you are at fault in an accident.

The main difference between PIP and Bodily Injury Liability is who is covered. PIP covers you and your passengers, while Bodily Injury Liability covers other drivers and passengers. Both types of insurance can be beneficial, but they serve different purposes.

How to Get Personal Injury Protection in Hawaii

Getting Personal Injury Protection in Hawaii is easy. It is a mandatory coverage that must be included in every car insurance policy in the state. When you purchase car insurance in Hawaii, PIP will automatically be included in your policy.

However, you may have the option to increase your PIP coverage if you wish. This can provide added protection in case of an accident.

Conclusion

Personal Injury Protection is a mandatory coverage in Hawaii that covers medical expenses and lost wages in case of an accident. It is a valuable type of insurance that ensures you are protected, regardless of who was at fault. If you are purchasing car insurance in Hawaii, make sure that PIP is included in your policy.

Contents

Frequently Asked Questions

Here are some common questions regarding personal injury protection in Hawaii:

What is Personal Injury Protection?

Personal Injury Protection (PIP) is an insurance coverage that helps pay for medical expenses, lost wages, and other related expenses if you are injured in a car accident. It is also known as no-fault insurance because it is designed to cover your own injuries regardless of who is at fault for the accident.

In Hawaii, PIP is mandatory for all drivers and vehicle owners. The minimum coverage requirement is $10,000 per person, per accident.

What Does Personal Injury Protection Cover?

PIP covers medical expenses, lost wages, and other related expenses if you are injured in a car accident. This includes hospital bills, doctor’s visits, prescriptions, and rehabilitation services. PIP also covers lost wages if you are unable to work due to your injuries.

In addition, PIP may cover other expenses such as funeral costs, childcare expenses, and household services if you are unable to perform these tasks due to your injuries.

Is Personal Injury Protection Required for Motorcycles?

Yes, personal injury protection is required for motorcycles in Hawaii. The minimum coverage requirement is $10,000 per person, per accident. This coverage is mandatory for all drivers and owners of motorcycles in Hawaii.

It is important to note that motorcyclists are at a higher risk of injury in accidents compared to other vehicles due to the lack of protection. PIP can help cover medical expenses and other related costs if you are injured in a motorcycle accident.

Can I Waive Personal Injury Protection in Hawaii?

No, you cannot waive personal injury protection in Hawaii. PIP is mandatory for all drivers and vehicle owners in the state. The only exception to this rule is for motorcycles that are covered by a health insurance policy that meets the state’s minimum coverage requirements for PIP.

It is important to have PIP coverage in case you are injured in a car accident, even if you have health insurance. PIP can help cover expenses that health insurance may not cover, such as lost wages and household services.

What Happens if I Don’t Have Personal Injury Protection?

If you are caught driving without personal injury protection in Hawaii, you may face fines, license suspension, and other penalties. In addition, if you are injured in a car accident, you may be responsible for paying for your own medical expenses and related costs.

Having PIP coverage can help protect you financially in case you are injured in a car accident. It is important to make sure you have the required coverage to avoid penalties and financial hardship in the event of an accident.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is indeed required in Hawaii. This coverage is designed to help drivers and passengers cover medical expenses and lost wages in the event of an accident, regardless of who is at fault. While Hawaii is a no-fault state, PIP can still be a valuable asset for those who are injured in an accident.

Whether you are a resident of Hawaii or just visiting, it is important to understand the state’s insurance requirements. PIP is just one of several types of coverage that drivers must carry in Hawaii. By staying informed and up-to-date on these requirements, you can protect yourself and your loved ones in the event of an accident.

Ultimately, PIP is an essential component of auto insurance in Hawaii. While it may seem like an added expense, this coverage can provide vital financial support during a difficult time. So if you are a driver in Hawaii, make sure you have the necessary insurance coverage to stay safe and protected on the road.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts