A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

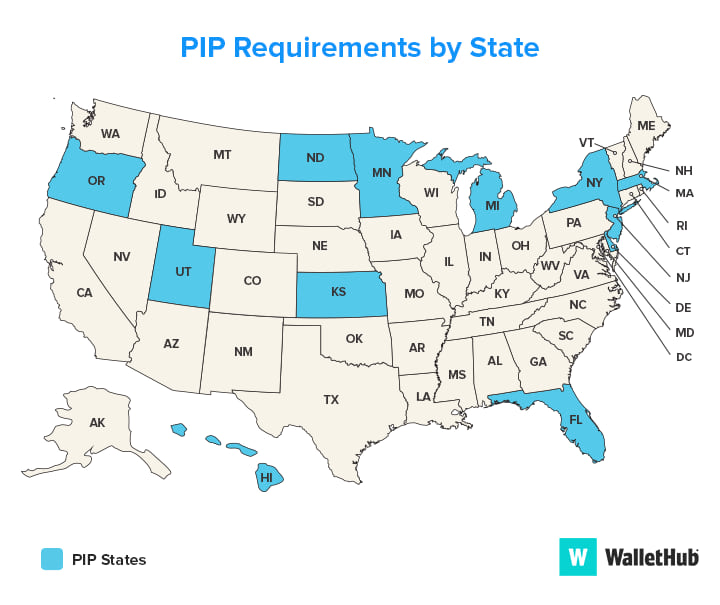

Delaware residents who own a vehicle may be wondering if they are required to have Personal Injury Protection (PIP) as part of their car insurance policy. PIP is a type of coverage that helps pay for medical expenses and lost wages in the event of an accident, regardless of who is at fault.

In Delaware, PIP is mandatory for all drivers and vehicle owners. Failure to have PIP coverage can result in fines and license suspension. But what exactly does PIP cover, and how much coverage is needed? Let’s delve into the details of Delaware’s PIP laws.

Yes, Personal Injury Protection (PIP) is required in Delaware for all registered vehicles. The minimum coverage required is $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage. PIP provides coverage for medical expenses, lost wages, and other related expenses in case of an accident, regardless of who was at fault.

Is Personal Injury Protection Required in Delaware?

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of an accident. It is also known as no-fault insurance because it pays out regardless of who is at fault for the accident. In Delaware, PIP is mandatory for all drivers who own a vehicle.

There are two types of PIP coverage available in Delaware: Basic and Enhanced. Basic coverage provides up to $15,000 in medical expenses and lost wages, while Enhanced coverage provides up to $30,000 in medical expenses and lost wages.

Why is PIP Required in Delaware?

PIP is required in Delaware to ensure that drivers have access to medical care and lost wages in the event of an accident. It also helps to reduce the number of lawsuits filed after an accident, as PIP covers medical expenses regardless of who is at fault.

Another reason why PIP is required in Delaware is to reduce the financial burden on the state’s Medicaid system. Without PIP, many accident victims would be forced to rely on Medicaid to cover their medical expenses.

The Benefits of PIP

There are several benefits to having PIP coverage in Delaware. Firstly, it ensures that you have access to medical care and lost wages if you are involved in an accident. This can be especially important if you do not have health insurance or disability insurance.

Secondly, PIP can help to reduce the financial burden on your family if you are unable to work due to an accident. It can provide a source of income while you recover from your injuries.

Finally, PIP can help to reduce the number of lawsuits filed after an accident. Because PIP covers medical expenses regardless of who is at fault, there is less incentive for accident victims to sue the other driver for damages.

PIP vs. Other Types of Insurance

PIP is different from other types of car insurance because it covers medical expenses and lost wages regardless of who is at fault. Other types of insurance, such as liability insurance, only cover damages that you cause to other people or their property.

While PIP is mandatory in Delaware, other types of insurance are optional. However, it is recommended that you carry liability insurance in addition to PIP, as liability insurance can protect you from financial ruin if you cause an accident.

The Cost of PIP

The cost of PIP coverage in Delaware varies depending on several factors, including your age, driving record, and the type of coverage you choose. Basic coverage is generally less expensive than Enhanced coverage.

It is important to shop around and compare quotes from different insurance companies to find the best deal on PIP coverage. You may also be eligible for discounts if you have a good driving record, take a defensive driving course, or bundle your PIP coverage with other types of insurance.

How to Obtain PIP Coverage

In Delaware, PIP coverage is included in your car insurance policy. When you purchase car insurance, you will be asked to choose between Basic and Enhanced PIP coverage.

It is important to read your insurance policy carefully to understand exactly what is covered under your PIP coverage. You should also be aware of any deductibles or co-payments that may apply.

What to Do After an Accident

If you are involved in an accident in Delaware, you should seek medical attention immediately, even if you do not feel injured. You should also report the accident to your insurance company as soon as possible.

Your insurance company will provide you with instructions on how to file a claim for PIP benefits. You may be required to provide medical records and other documentation to support your claim.

The Bottom Line

In conclusion, Personal Injury Protection (PIP) is mandatory for all drivers in Delaware. PIP provides coverage for medical expenses and lost wages in the event of an accident, regardless of who is at fault. While PIP can help to reduce the financial impact of an accident, it is important to shop around and compare quotes from different insurance companies to find the best deal on PIP coverage.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) in Delaware?

- Who needs to have Personal Injury Protection (PIP) in Delaware?

- What does Personal Injury Protection (PIP) cover in Delaware?

- Is Personal Injury Protection (PIP) the same as bodily injury liability insurance?

- Can I waive Personal Injury Protection (PIP) coverage in Delaware?

- Maximizing Your Personal Injury Protection Claims in Delaware

Frequently Asked Questions

What is Personal Injury Protection (PIP) in Delaware?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. PIP insurance is also known as no-fault insurance because it covers your medical expenses regardless of who caused the accident.

Who needs to have Personal Injury Protection (PIP) in Delaware?

In Delaware, all drivers are required to have Personal Injury Protection (PIP) as part of their car insurance policy. The minimum amount of PIP coverage that you must have is $15,000 per person and $30,000 per accident.

What does Personal Injury Protection (PIP) cover in Delaware?

Personal Injury Protection (PIP) in Delaware covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. PIP insurance also covers funeral expenses and survivor benefits if someone is killed in a car accident.

Is Personal Injury Protection (PIP) the same as bodily injury liability insurance?

No, Personal Injury Protection (PIP) is not the same as bodily injury liability insurance. PIP insurance covers your own medical expenses and lost wages if you are injured in a car accident, while bodily injury liability insurance pays for medical expenses, lost wages, and other related expenses if you are at fault for injuring someone else in a car accident.

Can I waive Personal Injury Protection (PIP) coverage in Delaware?

No, you cannot waive Personal Injury Protection (PIP) coverage in Delaware. PIP insurance is required by law for all drivers in Delaware, and it is designed to protect you and your passengers in the event of a car accident. However, you can choose to increase your PIP coverage if you want more protection.

Maximizing Your Personal Injury Protection Claims in Delaware

In conclusion, the answer to the question “Is Personal Injury Protection required in Delaware?” is a resounding yes. This type of insurance coverage is mandatory for all Delaware drivers and helps protect them in the event of an accident. While the cost of PIP insurance can vary depending on a variety of factors, it is well worth the investment to ensure you are covered in case of an unexpected injury.

Overall, PIP insurance is an important aspect of responsible driving in Delaware. It not only provides peace of mind while on the road, but it also ensures that all drivers have access to the medical care they need in the event of an accident. So, if you’re a Delaware driver, be sure to add PIP coverage to your insurance policy and drive safely!

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts