A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

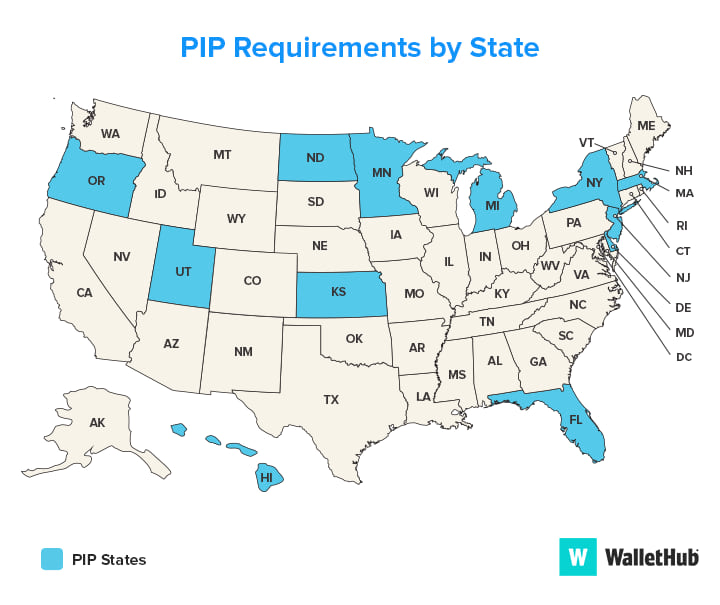

Personal injury protection (PIP) is a type of insurance coverage that helps pay for medical expenses, lost wages, and other related expenses if you are injured in a car accident. While this coverage is mandatory in some states, many drivers in California are left wondering whether PIP is required in their state.

If you’re a driver in California, understanding your insurance requirements is crucial to ensure that you are adequately protected on the road. In this article, we’ll explore the ins and outs of PIP coverage in California to help you make informed decisions about your insurance options.

Personal Injury Protection (PIP) is not required in California. However, drivers can opt for Medical Payments Coverage, which pays for medical expenses regardless of who is at fault in an accident. PIP is typically required in no-fault states, but California is an at-fault state. It is important to review your insurance policy and discuss your options with your insurance agent to ensure you have adequate coverage.

Is Personal Injury Protection Required in California?

Understanding Personal Injury Protection

Personal injury protection, or PIP, is a type of car insurance that covers medical expenses and other related costs resulting from a car accident, regardless of who is at fault. PIP is often referred to as “no-fault” insurance because it provides benefits regardless of who caused the accident.

In California, PIP is not mandatory, but it is an optional coverage that can be added to your car insurance policy. PIP is intended to cover medical expenses, lost wages, and other related expenses that result from a car accident.

If you are considering adding PIP to your car insurance policy, it is important to understand how it works and what it covers. PIP can provide valuable protection for you and your passengers in the event of an accident, but it is not always necessary.

The Benefits of Personal Injury Protection

One of the main benefits of PIP is that it provides coverage for medical expenses and related costs, regardless of who is at fault for the accident. This means that if you or your passengers are injured in a car accident, your medical expenses will be covered up to the limits of your PIP policy, regardless of whether or not you caused the accident.

PIP can also provide coverage for lost wages resulting from a car accident. If you are unable to work due to your injuries, PIP can provide a portion of your lost wages, up to the limits of your policy.

Another benefit of PIP is that it can cover other related expenses, such as transportation costs to and from medical appointments, and even childcare expenses if you are unable to care for your children due to your injuries.

PIP vs. Medical Payments Coverage

In addition to PIP, another type of car insurance coverage that can help cover medical expenses resulting from a car accident is medical payments coverage, or MedPay. MedPay is similar to PIP in that it provides coverage for medical expenses, regardless of who is at fault for the accident.

However, there are some key differences between PIP and MedPay. While PIP can provide coverage for lost wages and other related expenses, MedPay only covers medical expenses. Additionally, PIP typically has higher coverage limits than MedPay.

Is PIP Right for You?

Whether or not PIP is the right choice for you depends on a variety of factors, including your budget, your medical insurance coverage, and how much risk you are willing to assume.

If you have a good health insurance plan that covers medical expenses resulting from a car accident, you may not need PIP coverage. However, if your health insurance plan has high deductibles or co-pays, or if you do not have health insurance at all, PIP can provide valuable protection.

If you are concerned about lost wages or other related expenses resulting from a car accident, PIP can provide coverage for these costs. However, if you have disability insurance or other types of coverage that can help cover these expenses, PIP may not be necessary.

Conclusion

In conclusion, while PIP is not required in California, it can provide valuable protection for you and your passengers in the event of a car accident. PIP can help cover medical expenses, lost wages, and other related expenses, regardless of who is at fault for the accident. Whether or not PIP is right for you depends on your individual circumstances and how much risk you are willing to assume.

Contents

- Frequently Asked Questions

- What is personal injury protection?

- What types of car insurance are required in California?

- Is personal injury protection worth it in California?

- Can I add personal injury protection to my car insurance policy in California?

- What should I do if I am involved in a car accident in California?

- What is Personal Injury Protection (PIP)?

Frequently Asked Questions

Personal injury protection (PIP) is a type of car insurance that covers medical expenses and lost wages for you and your passengers in case of an accident. It is a requirement in some states, but is it required in California? Here are some frequently asked questions regarding personal injury protection in California.

What is personal injury protection?

Personal injury protection, also known as PIP, is a type of car insurance that covers medical expenses and lost wages for you and your passengers in case of an accident. It is designed to provide financial protection for you and your passengers, regardless of who is at fault for the accident.

However, personal injury protection is not required in California. The state has a fault-based insurance system, which means that the person who is at fault for the accident is responsible for paying for the damages and injuries caused by the accident.

What types of car insurance are required in California?

California requires drivers to have liability insurance, which covers damages and injuries that you may cause to other people or their property. The minimum liability insurance requirements in California are $15,000 for bodily injury liability per person, $30,000 for bodily injury liability per accident, and $5,000 for property damage liability per accident.

In addition to liability insurance, California also requires uninsured motorist coverage and underinsured motorist coverage. These types of insurance cover your medical expenses and lost wages if you are hit by a driver who does not have insurance or does not have enough insurance to cover your damages and injuries.

Is personal injury protection worth it in California?

Since personal injury protection is not required in California, you may be wondering if it is worth getting. The answer depends on your personal situation and preferences. If you have health insurance that covers car accident injuries, you may not need personal injury protection.

However, if you do not have health insurance or have limited coverage, personal injury protection can provide additional financial protection in case of an accident. It can cover your medical expenses and lost wages, regardless of who is at fault for the accident.

Can I add personal injury protection to my car insurance policy in California?

Yes, you can add personal injury protection to your car insurance policy in California. Some insurance companies offer personal injury protection as an optional coverage, which you can add to your policy for an additional premium.

It is important to note that personal injury protection is not required in California, so you should weigh the costs and benefits of adding this coverage to your policy.

What should I do if I am involved in a car accident in California?

If you are involved in a car accident in California, you should first seek medical attention for any injuries. You should also exchange contact and insurance information with the other driver(s) involved in the accident.

It is important to report the accident to your insurance company as soon as possible, even if you are not at fault for the accident. Your insurance company can help you navigate the claims process and determine your coverage options.

What is Personal Injury Protection (PIP)?

In conclusion, Personal Injury Protection (PIP) is not required in California, but it may still be beneficial to have. PIP can provide coverage for medical expenses and lost wages in the event of an accident, regardless of who is at fault. Additionally, PIP can offer peace of mind and financial protection in the event of an unexpected accident.

While PIP is not mandatory in California, it’s important to consider the potential benefits of having this type of coverage. If you’re concerned about protecting yourself and your finances in the event of an accident, it may be worth looking into PIP options in your area. Ultimately, the decision to purchase PIP is up to the individual, but it’s important to weigh the potential benefits against the cost of the coverage to make an informed decision.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts