A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Personal injury settlements can provide much-needed relief to those who have been injured and faced financial burdens as a result. However, there is often confusion around whether these settlements are considered income and subject to taxes. It’s important to understand the laws and regulations surrounding personal injury settlements to avoid any unexpected tax liabilities.

In this article, we’ll explore whether personal injury settlements are considered income, the tax implications of receiving a settlement, and how to properly report settlements on your tax return. By the end, you’ll have a better understanding of the tax implications of personal injury settlements and be better prepared to handle any potential tax issues that may arise.

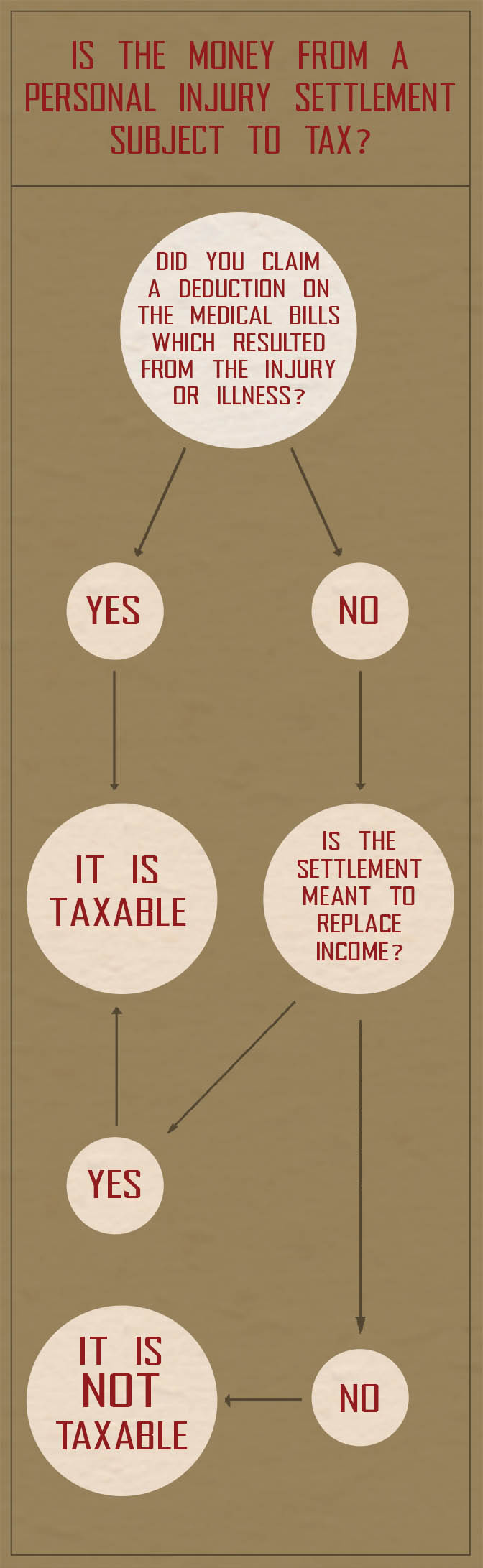

A personal injury settlement may or may not be considered as income depending on the circumstances. If the settlement is meant to compensate for physical injuries or sickness, it is generally not taxable. However, if the settlement is for lost wages or punitive damages, it may be subjected to taxes. It is important to consult a tax professional to determine the taxability of a personal injury settlement.

Is a Personal Injury Settlement Considered Income?

Receiving a personal injury settlement can be a relief after going through the stress of a legal battle. However, you may be wondering if this settlement is considered income and whether it is taxable by the government. In this article, we will take a closer look at the taxability of personal injury settlements.

What is a Personal Injury Settlement?

A personal injury settlement is a payment made by an individual or business to an injured party to compensate them for their injuries or damages. These settlements can be reached through negotiations or court proceedings. Personal injury settlements can cover a variety of damages, including medical bills, lost wages, pain and suffering, and property damage.

When a personal injury settlement is reached, it is important to understand the tax implications of the settlement. In general, personal injury settlements are not considered taxable income by the IRS.

Why is a Personal Injury Settlement not Taxable?

Personal injury settlements are not considered taxable income because they are not considered to be earnings or payment for services rendered. Rather, they are considered to be compensation for damages suffered as a result of an injury. This means that the settlement is not subject to federal income tax.

In addition, personal injury settlements are also exempt from state income tax in most cases. However, it is important to note that there are some exceptions to this rule, and it is always best to consult with a tax professional to determine the tax implications of a personal injury settlement.

When is a Personal Injury Settlement Taxable?

While personal injury settlements are generally not taxable, there are some situations in which they can be subject to taxation. For example, if any portion of the settlement is for lost wages or other taxable income, that portion may be subject to federal and state income tax.

Additionally, if the settlement includes punitive damages, these damages may be subject to taxation. Punitive damages are awarded to punish the defendant for their actions and are not considered compensation for the injured party.

Benefits of a Personal Injury Settlement

One of the main benefits of a personal injury settlement is that it can provide financial relief to the injured party. This relief can come in the form of compensation for medical bills, lost wages, and pain and suffering. Additionally, personal injury settlements can provide closure to the injured party, allowing them to move on from the incident and begin the healing process.

Another benefit of a personal injury settlement is that it can help hold the responsible party accountable for their actions. By seeking damages through a settlement or court case, the injured party can help prevent similar incidents from occurring in the future.

Personal Injury Settlements vs. Workers’ Compensation

While personal injury settlements are typically reached through negotiations or court proceedings, workers’ compensation is a type of insurance that provides benefits to employees who are injured on the job. Workers’ compensation benefits can cover medical bills, lost wages, and rehabilitation costs.

The main difference between personal injury settlements and workers’ compensation is that workers’ compensation benefits are generally not taxable. However, unlike personal injury settlements, workers’ compensation benefits are typically limited to specific damages and do not include compensation for pain and suffering.

Conclusion

In conclusion, personal injury settlements are generally not considered taxable income by the IRS. However, there are some situations in which a portion of the settlement may be subject to federal and state income tax. It is always best to consult with a tax professional to determine the tax implications of a personal injury settlement.

Personal injury settlements provide financial relief and closure to injured parties, and can help hold responsible parties accountable for their actions. While workers’ compensation benefits are generally not taxable, they are typically limited to specific damages and do not include compensation for pain and suffering.

Contents

- Frequently Asked Questions

- What is a Personal Injury Settlement?

- Is a Personal Injury Settlement Considered Taxable Income?

- Do I Need to Report My Personal Injury Settlement to the IRS?

- Can a Personal Injury Settlement Affect My Eligibility for Government Benefits?

- Do I Need to Pay Taxes on My Personal Injury Settlement if I Live in a Different State?

- Is A Personal Injury Settlement Considered Income? Here’s What You Need To Know

Frequently Asked Questions

What is a Personal Injury Settlement?

A personal injury settlement is a payment made to a person who has suffered an injury or harm because of someone else’s negligence or intentional act. The settlement is typically awarded to compensate the injured person for medical expenses, lost wages, pain and suffering, and other damages related to the injury.

Personal injury settlements can be reached through negotiations between the injured person and the responsible party or their insurance company, or through a court judgment.

Is a Personal Injury Settlement Considered Taxable Income?

In most cases, personal injury settlements are not considered taxable income under federal tax law. This is because they are intended to compensate the injured person for their losses and not to provide them with additional income.

However, there are exceptions to this rule. If the settlement includes punitive damages or interest, those amounts may be subject to taxation. Additionally, if the injured person deducted medical expenses related to the injury in a previous tax year, they may need to report some or all of the settlement as income.

Do I Need to Report My Personal Injury Settlement to the IRS?

If your personal injury settlement is not considered taxable income, you do not need to report it to the IRS. However, if any portion of the settlement is subject to taxation, you will need to report it on your tax return.

If you are unsure whether your settlement is taxable, it is recommended that you consult with a tax professional or attorney who has experience with personal injury settlements and taxation.

Can a Personal Injury Settlement Affect My Eligibility for Government Benefits?

It is possible that a personal injury settlement could affect your eligibility for government benefits such as Medicaid or Supplemental Security Income (SSI). This is because these programs have strict income and asset limits that must be met in order to qualify.

If your settlement is considered taxable income, it could also affect your eligibility for certain tax credits and deductions. It is important to consult with an attorney or financial advisor to determine how your settlement may impact your eligibility for government benefits and tax obligations.

Do I Need to Pay Taxes on My Personal Injury Settlement if I Live in a Different State?

If you received a personal injury settlement and live in a different state than where the injury occurred, you may be subject to taxation in both states. This is because some states have different laws regarding taxation of personal injury settlements.

It is important to consult with a tax professional or attorney who is familiar with the tax laws in both states to determine your tax obligations and avoid any potential penalties or legal issues.

Is A Personal Injury Settlement Considered Income? Here’s What You Need To Know

In conclusion, a personal injury settlement can be a complicated matter when it comes to taxes and income. While some portions of the settlement may be considered taxable income, others may be exempt. It’s important to consult with a tax professional to ensure that you fully understand the tax implications of your settlement.

However, it’s important to remember that a personal injury settlement is ultimately meant to compensate you for the damages you suffered as a result of the injury. Whether the settlement is taxable or not, it’s important to use the funds to cover any medical bills, lost wages, and other expenses related to your injury.

At the end of the day, the most important thing is to focus on your recovery and getting your life back on track. Don’t let the tax implications of your settlement distract you from what’s truly important – healing and moving forward.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts