A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Car accidents are an unfortunate reality that can happen to anyone. Whether it’s a small fender bender or a major collision, dealing with the aftermath can be overwhelming, especially when it comes to handling insurance. Knowing how to navigate the ins and outs of insurance after a car accident can not only save you time and money but also help you get back on the road as soon as possible.

From understanding your coverage to filing a claim, there are several steps you can take to make the insurance process smoother. In this guide, we’ll walk you through everything you need to know about handling insurance after a car accident, so you can feel confident and informed every step of the way. So buckle up and let’s get started!

After a car accident, the first step is to inform your insurance company and provide them with all the necessary information. Your insurer will assign a claims adjuster who will evaluate the damage and estimate the cost of repairs. They will also determine who was at fault and negotiate with the other party’s insurer if necessary. Be sure to keep all records and receipts related to the accident for your insurance claim.

How to Handle Insurance After a Car Accident

Car accidents can be a stressful and traumatic experience, and dealing with insurance companies afterwards can often add to the stress. It’s important to know how to handle insurance after a car accident to ensure that you receive the proper compensation and coverage for any damages or injuries. Here are some tips to help you navigate the insurance process.

1. Contact Your Insurance Company

The first step after a car accident is to contact your insurance company as soon as possible. Your insurance agent will guide you through the claims process and help you understand your policy coverage. Make sure to provide them with accurate and complete information about the accident to avoid any delays or complications.

It’s also important to note that you should never admit fault or accept blame for the accident. Let the insurance company handle the investigation and determine who is at fault.

2. Gather Information

Before contacting your insurance company, gather as much information about the accident as possible. This includes the names and contact information of all parties involved, the make and model of the vehicles, and any witness information. Taking photos of the accident scene and damages can also be helpful.

Benefits:

– Providing accurate information and evidence can help speed up the claims process.

– Having all the necessary information can also help you understand your policy coverage and ensure that you receive the proper compensation.

3. Understand Your Policy Coverage

It’s important to understand your policy coverage and what is and isn’t covered. Your insurance agent can help you review your policy and explain any terms or conditions that may apply to your claim.

If you have collision coverage, your insurance company will cover the cost of repairs to your vehicle regardless of who is at fault. If you have liability coverage, your insurance company will cover damages and injuries caused to other parties if you are at fault.

Benefits:

– Knowing your policy coverage can help you avoid any surprises or unexpected costs.

– Understanding your coverage can also help you make informed decisions about your claim.

4. File a Claim

After gathering all the necessary information and understanding your policy coverage, it’s time to file a claim with your insurance company. Your insurance agent will guide you through the process and help you fill out any necessary forms.

Make sure to provide accurate and complete information to avoid any delays or complications. Your insurance company may also request additional information or documentation to support your claim.

Benefits:

– Filing a claim is necessary to receive compensation for damages or injuries.

– Providing accurate information and documentation can help speed up the claims process.

5. Cooperate with the Insurance Company

Cooperating with the insurance company is important to ensure a smooth claims process. This includes providing accurate information, responding to any requests in a timely manner, and following up on the status of your claim.

It’s also important to keep records of all communication with the insurance company, including phone calls, emails, and letters.

Benefits:

– Cooperating with the insurance company can help ensure that your claim is processed quickly and efficiently.

– Keeping records of communication can help protect your rights and ensure that you receive the proper compensation.

6. Consider Hiring an Attorney

If you are having difficulty with the insurance company or feel that you are not receiving the proper compensation, it may be necessary to hire an attorney. An attorney can help you navigate the legal process and protect your rights.

It’s important to note that hiring an attorney can be expensive and may not always be necessary. Your insurance agent may be able to help you resolve any issues with the insurance company without the need for legal assistance.

Benefits:

– Hiring an attorney can help protect your rights and ensure that you receive the proper compensation.

– An attorney can also help you navigate the legal process and provide guidance on your options.

7. Be Patient

The insurance claims process can often be lengthy and frustrating. It’s important to be patient and follow up with the insurance company on the status of your claim.

Keep in mind that the insurance company may need to investigate the accident and gather additional information before making a decision on your claim.

Benefits:

– Being patient can help ensure that your claim is processed correctly and efficiently.

– Following up with the insurance company can help keep your claim on track and avoid any delays.

8. Know Your Rights

As a policyholder, you have certain rights when dealing with insurance companies. It’s important to know and understand these rights to ensure that you are treated fairly and receive the proper compensation.

Some of these rights include the right to a fair and prompt claims process, the right to review and dispute any decisions made by the insurance company, and the right to file a complaint with the state insurance commissioner.

Benefits:

– Knowing your rights can help protect you from unfair treatment by the insurance company.

– Understanding your rights can also help you make informed decisions about your claim.

9. Consider Your Options

If you are not satisfied with the insurance company’s decision on your claim, there may be other options available to you. This may include filing a complaint with the state insurance commissioner, pursuing legal action, or seeking mediation or arbitration.

It’s important to weigh your options carefully and consider the potential costs and benefits of each option.

Benefits:

– Considering your options can help ensure that you receive the proper compensation and protect your rights.

– Knowing your options can also help you make informed decisions about your claim.

10. Review Your Policy

After the claims process is complete, it’s important to review your policy and make any necessary updates or changes. This may include adjusting your coverage limits, adding additional coverage, or changing your deductible.

It’s also a good idea to review your policy on a regular basis to ensure that it still meets your needs and provides the proper protection.

Benefits:

– Reviewing your policy can help ensure that you have the proper coverage and protection.

– Updating your policy can also help you save money and avoid any surprises or unexpected costs.

In conclusion, handling insurance after a car accident can be a complex and stressful process. By following these tips and understanding your rights and options, you can ensure that you receive the proper compensation and protection. Remember to contact your insurance company as soon as possible, gather all necessary information, file a claim, cooperate with the insurance company, and consider your options if necessary.

Frequently Asked Questions

Car accidents can be overwhelming, and dealing with insurance can add to the stress. Here are some frequently asked questions about how to handle insurance after a car accident.

What should I do immediately after a car accident?

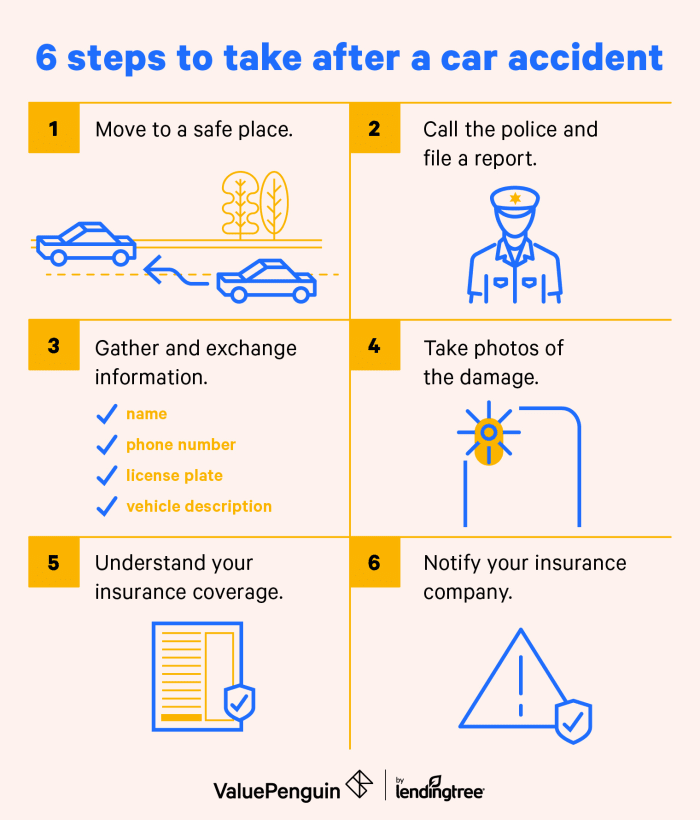

First, make sure everyone involved is safe and call for medical assistance if needed. Then, call the police and report the accident. Collect information from the other driver(s) involved, such as their insurance information and contact details. Take photos of the damage and any injuries. Contact your insurance company and inform them of the accident.

It’s important to not admit fault or make any statements that could be used against you later. Stick to the facts and avoid discussing fault or blame until the investigation is complete.

How does the insurance claims process work?

After you report the accident to your insurance company, they will assign an adjuster to investigate the claim. The adjuster will review the police report, speak with witnesses, and assess the damage to determine how much the insurance company will cover. You may be asked to provide additional information or documentation to support your claim.

If the other driver was at fault, their insurance company will likely be involved in the claims process as well. Your insurance company may work with the other company to determine fault and decide how much each company will cover.

What if the other driver doesn’t have insurance?

If the other driver is at fault and doesn’t have insurance, you may have to rely on your own insurance coverage. Uninsured motorist coverage can help cover damages and medical expenses if you’re hit by a driver without insurance. However, if you don’t have uninsured motorist coverage, you may have to sue the other driver to recover damages.

If you live in a no-fault state, your insurance company may cover your damages regardless of who was at fault.

Should I accept a settlement offer from the insurance company?

Before accepting a settlement offer, make sure you understand the full extent of your damages. You may be entitled to more than the initial offer. Consider the cost of repairs, medical expenses, lost wages, and any pain and suffering you experienced as a result of the accident.

You may want to consult an attorney before accepting a settlement offer to make sure you’re getting a fair deal. Once you accept a settlement offer, you generally cannot pursue additional compensation for the same damages.

What if I disagree with the insurance company’s decision?

If you disagree with the insurance company’s decision, you may be able to appeal the decision or file a complaint with the state insurance department. You may also want to consult an attorney to help you navigate the appeals process and protect your legal rights.

Keep in mind that the appeals process can be lengthy and may not result in a different decision. It’s important to carefully review your policy and understand your rights before pursuing an appeal.

In conclusion, handling insurance after a car accident can be a daunting task, but by following the right steps, you can make the process less stressful and more manageable.

Firstly, it is important to gather all the necessary information, including the contact details of the other driver and any witnesses, and take pictures of the damage to your vehicle. This will help you to provide accurate information to your insurance company.

Secondly, be honest and transparent with your insurance company about the accident and any injuries or damages sustained. Any false information could lead to complications and potentially result in your claim being denied.

Lastly, consider seeking legal advice if you are unsure about the insurance process or if you have been unfairly denied a claim. A lawyer can help you understand your rights and navigate the complex legal system.

Remember, accidents happen, but by being prepared and informed, you can ensure that you receive the compensation you deserve.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts