A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Biking is a popular mode of transportation for many people, whether for pleasure or commuting. But accidents can happen, and it’s important to know if your homeowners insurance covers bike accidents. While you may assume that your insurance policy covers all types of accidents, it’s not always the case. So, let’s dive into the details to find out if your homeowners insurance provides coverage for bike accidents.

Many homeowners insurance policies provide coverage for personal liability, which includes coverage for accidents that occur on your property or off-premises. However, the coverage may vary depending on the policy you have. It’s crucial to understand the details of your policy to know if you’re covered in case of a bike accident.

Yes, most homeowners insurance policies cover bike accidents. However, the coverage amount may vary depending on the policy and the extent of the damage caused by the accident. It’s important to review your policy’s terms and conditions to know the exact coverage amount and limitations. Homeowners insurance may also cover theft or vandalism of your bike if it occurs on your property.

Does Homeowners Insurance Cover Bike Accidents?

Bicycling is a great way to stay active, save on gas, and reduce your carbon footprint. However, bike accidents can happen anytime and anywhere, even in your own backyard. That’s why it’s essential to know whether homeowners insurance covers bike accidents or not. In this article, we will explore the ins and outs of homeowners insurance and bike accidents.

What is Homeowners Insurance?

Homeowners insurance is a type of insurance that protects your home and personal belongings from unexpected events such as theft, fire, or natural disasters. Homeowners insurance typically covers your home, other structures on your property, personal property, liability, and additional living expenses. However, it’s important to note that every policy is different, and you should read your policy carefully to understand what is covered and what is not.

Does Homeowners Insurance Cover Bike Accidents?

The short answer is, it depends. Homeowners insurance may cover bike accidents under certain circumstances. If the bike accident occurs on your property, your homeowners insurance liability coverage may cover the damages to the other party. However, if you are at fault in the accident, you may be personally liable for the damages.

If the bike accident occurs off your property, your homeowners insurance may not cover the damages. In this case, you may need to rely on your auto insurance, health insurance, or the other party’s insurance to cover the damages.

What Factors Affect Homeowners Insurance Coverage for Bike Accidents?

Several factors can affect homeowners insurance coverage for bike accidents. These include:

Location:

Some states require homeowners insurance policies to cover bike accidents up to a certain amount. However, other states do not have such requirements, and it’s up to the insurance company to decide what is covered.

Policy Coverage:

Your homeowners insurance policy may provide liability coverage for bike accidents, but it may not cover damages to your bike or injuries to you.

Type of Bike:

Your homeowners insurance may cover a traditional bike, but it may not cover an electric bike or a high-end bike. You may need to purchase additional coverage for these types of bikes.

Other Parties Involved:

If the other party involved in the bike accident has insurance, their insurance may cover the damages instead of your homeowners insurance.

Benefits of Homeowners Insurance for Bike Accidents

Having homeowners insurance that covers bike accidents can provide several benefits, including:

Peace of Mind:

Knowing that you have insurance coverage can give you peace of mind while you are out riding your bike.

Financial Protection:

If you are involved in a bike accident, having insurance coverage can protect you from financial losses.

Legal Protection:

If you are sued by the other party involved in the bike accident, your homeowners insurance may provide legal protection and cover the costs of a lawsuit.

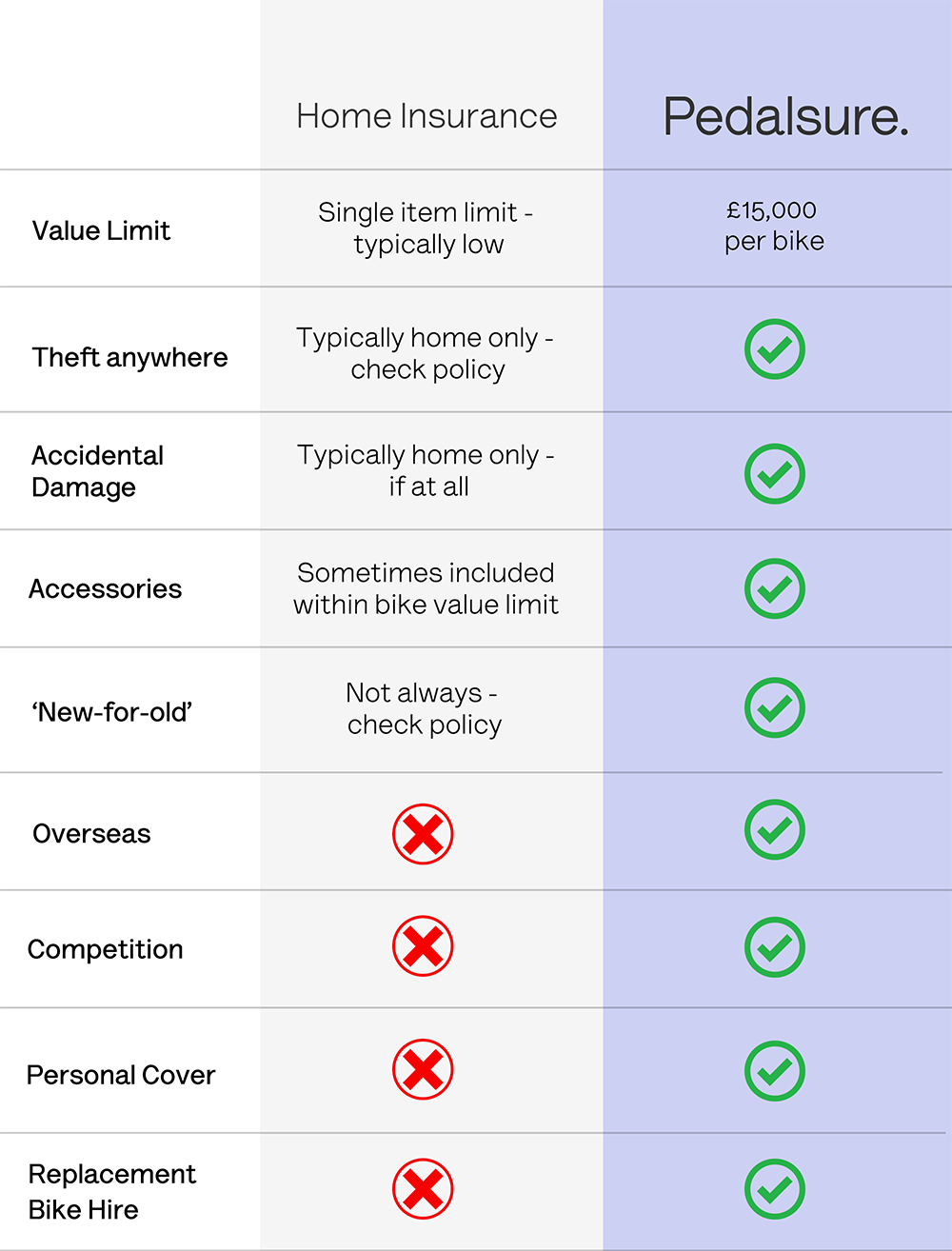

Homeowners Insurance vs. Bicycle Insurance

While homeowners insurance may cover bike accidents under certain circumstances, it may not provide comprehensive coverage for your bike. Bicycle insurance is a specialized insurance policy that provides coverage for bike theft, damage, and liability. Bicycle insurance may also cover accessories such as helmets and locks. If you own an expensive bike or ride frequently, you may want to consider purchasing bicycle insurance in addition to your homeowners insurance.

Conclusion

In summary, homeowners insurance may cover bike accidents under certain circumstances. However, it’s important to read your policy carefully to understand what is covered and what is not. If you frequently ride your bike or own an expensive bike, you may want to consider purchasing bicycle insurance in addition to your homeowners insurance. Remember, the best way to protect yourself from bike accidents is to practice safe riding habits and follow traffic laws.

Frequently Asked Questions

What is covered by homeowners insurance?

Homeowners insurance typically covers damage to your home and personal property caused by covered perils such as fire, theft, and weather events. It may also provide liability coverage if someone is injured on your property.

Does homeowners insurance cover bike accidents?

In most cases, yes. Homeowners insurance typically provides liability coverage for accidents that occur on your property, including those involving bicycles. However, coverage limits may vary depending on your policy and the specific circumstances of the accident.

What types of bike accidents are covered by homeowners insurance?

Homeowners insurance typically covers bike accidents that occur on your property, such as a collision with a guest or a family member. It may also cover accidents that occur off your property, such as if you or a family member causes an accident while riding a bike away from home.

What should I do if I’m in a bike accident on my property?

If you’re involved in a bike accident on your property, the first thing you should do is seek medical attention if necessary. You should also document the accident by taking photos of the scene and obtaining contact information from any witnesses. Finally, you should contact your homeowners insurance provider to report the accident and begin the claims process.

How can I make sure I have enough coverage for bike accidents?

To ensure you have adequate coverage for bike accidents, you should review your homeowners insurance policy and speak with your insurance provider. You may need to increase your liability coverage limits or consider purchasing additional coverage, such as an umbrella policy, to protect yourself in the event of a serious accident.

In conclusion, homeowners insurance may or may not cover bike accidents depending on the circumstances. It’s important to review your policy and speak with your insurance provider to fully understand your coverage. If you regularly ride your bike, it may be worth considering additional coverage specifically for bike accidents.

Remember, prevention is key when it comes to bike accidents. Always wear a helmet and follow traffic laws to reduce the risk of an accident. In the event of an accident, seek medical attention and document any damages or injuries. This will help you when filing a claim with your insurance provider.

Overall, understanding your homeowners insurance coverage and taking preventative measures can help protect you and your bike in the event of an accident. Stay safe on the road and enjoy your rides with peace of mind.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts