A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Car accidents are a common occurrence on the roads, and they can be both frustrating and costly. If you have been involved in an accident, you may be wondering if you can claim depreciation on your car. This is a valid question, as depreciation can significantly impact the value of your vehicle over time. In this article, we will explore the concept of depreciation and whether you can claim it after a car accident.

Depreciation is the reduction in value of an asset over time. In the case of a car, it is the decrease in value due to wear and tear, age, and other factors. If your car has been in an accident, it is likely that its value has decreased due to the damage sustained. This is where the question of claiming depreciation arises. Let’s delve deeper into this topic and find out if you can indeed claim depreciation on your car after an accident.

If you use your car for business purposes and it was involved in an accident, you can claim depreciation on it. However, if the car was used for personal purposes, you cannot claim depreciation. The amount of depreciation you can claim will depend on the extent of the damage to the car and how much it has depreciated since you purchased it.

Can I Claim Depreciation on My Car After an Accident?

Understanding Car Depreciation

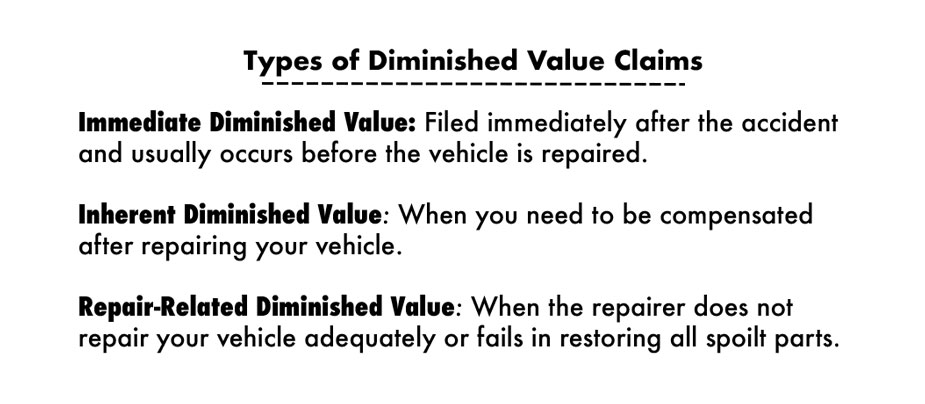

Car depreciation is a fact of life for car owners. It refers to the decrease in value of a car over time due to wear and tear, age, and usage. When you get into an accident, depreciation becomes a more immediate concern. The accident can cause significant damage to your car, which can lead to a decrease in its value. This decrease in value is known as “diminished value.”

Diminished value is the difference between the pre-accident value of your car and its value after repairs have been made. This decrease in value can be significant, especially if the repairs were extensive. So, can you claim depreciation on your car after an accident?

Depreciation After an Accident

The short answer is yes, you can claim depreciation after an accident. However, the process can be complicated. The first step is to determine the pre-accident value of your car. This can be done by looking up the value of your car in a valuation guide, such as Kelley Blue Book or NADA Guides.

Once you have determined the pre-accident value of your car, you will need to have it appraised after the repairs have been made. The appraiser will determine the post-accident value of your car. The difference between the pre-accident value and the post-accident value is the amount of depreciation you can claim.

The Benefits of Claiming Depreciation

Claiming depreciation after an accident can help you recover some of the value you lost due to the accident. This can be especially important if you plan to sell or trade in your car in the near future. By claiming depreciation, you can potentially increase the amount of money you receive for your car.

It is also important to note that some insurance companies may offer to pay for the diminished value of your car as part of your settlement. However, this is not always the case, and it is important to understand your rights and options when it comes to claiming depreciation.

Depreciation vs. Total Loss

It is important to understand the difference between claiming depreciation and claiming a total loss. Claiming a total loss means that your car has been so severely damaged that it is not worth repairing. In this case, the insurance company will pay you the actual cash value of your car, minus any deductibles and salvage value.

Claiming depreciation, on the other hand, means that your car can be repaired, but its value has been diminished due to the accident. In this case, you can claim the difference between the pre-accident value and the post-accident value of your car.

The Process of Claiming Depreciation

The process of claiming depreciation can be complicated, and it is important to work with a knowledgeable and experienced professional. You will need to provide documentation of the pre-accident value of your car, as well as the post-accident value.

Some states have specific laws regarding claiming depreciation, so it is important to research the laws in your state. In general, it is a good idea to work with an attorney or a licensed appraiser who can guide you through the process and help you get the compensation you deserve.

Conclusion

If you have been in an accident and your car has been damaged, claiming depreciation can be a way to recover some of the value you lost. However, the process can be complicated, and it is important to work with a knowledgeable professional. By understanding the process and your rights, you can make sure that you get the compensation you deserve.

Contents

Frequently Asked Questions

Here are some frequently asked questions about claiming depreciation on a car after an accident.

Question 1: What is depreciation and how does it affect my car?

Depreciation is the decrease in value of an asset over time. In the case of a car, it is the reduction in value due to wear and tear, age, and market conditions. When you purchase a car, it starts to depreciate immediately. As the car ages, the rate of depreciation slows down. A car that has been in an accident may depreciate faster than a car that has not been in an accident.

When you file a claim for an accident, your insurance company will assess the damage to your car and determine its value. The insurance company may deduct the cost of depreciation from the value of your car, which could reduce the amount of your payout.

Question 2: Can I claim depreciation on my car after an accident?

Yes, you can claim depreciation on your car after an accident. However, the amount of depreciation that you can claim may vary depending on the specific circumstances of your accident and the terms of your insurance policy. Your insurance company will typically deduct the cost of depreciation from the value of your car when calculating your payout. If you believe that the amount of depreciation deducted is unfair, you can try to negotiate with your insurance company or file an appeal.

It is important to note that you can only claim depreciation if you own the car. If you are leasing the car, the leasing company may claim the depreciation instead.

Question 3: How is the amount of depreciation calculated?

The amount of depreciation that is deducted from the value of your car will depend on several factors, such as the age and condition of your car, the extent of the damage, and the market value of similar cars. Your insurance company will typically use a formula to calculate the amount of depreciation, which may vary depending on the company and the state where you live.

If you feel that the amount of depreciation deducted is unfair, you can ask your insurance company to provide documentation and evidence to support their calculation. You may also want to consult with an independent appraiser to get a second opinion on the value of your car.

Question 4: Can I claim depreciation if my car is repaired?

If your car is repaired after an accident, you may still be able to claim depreciation. The amount of depreciation that you can claim will depend on the extent of the damage and the quality of the repairs. If the repairs are not done properly, your car may continue to depreciate faster than it would have otherwise.

If you are unsure about whether you can claim depreciation after your car has been repaired, you should consult with your insurance company or an independent appraiser.

Question 5: How can I protect my car from depreciation?

There are several ways to protect your car from depreciation, such as maintaining it regularly, avoiding accidents, and keeping it clean. You may also want to consider purchasing gap insurance, which can help cover the difference between the value of your car and the amount you owe on your loan or lease.

If you are concerned about depreciation, you should also do your research before purchasing a car. Some cars depreciate faster than others, so it is important to choose a car that will hold its value well over time.

In conclusion, claiming depreciation on your car after an accident can be a confusing and complex process. However, with the right information and guidance, it is possible to receive compensation for the diminished value of your vehicle. It is important to keep detailed records of the accident and any repairs made to your car, as well as to understand the factors that determine the amount of depreciation you can claim. By staying informed and seeking the help of professionals if necessary, you can ensure that you receive the compensation you are entitled to after an accident. So, don’t hesitate to explore your options and protect your rights as a car owner.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts