A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Slip and fall accidents can lead to serious injuries, and in some cases, result in legal action. If you are involved in a slip and fall case and receive a settlement, it’s important to understand the tax implications. Many people wonder whether slip and fall settlements are taxable, and the answer is not always straightforward. In this article, we will explore the tax implications of slip and fall settlements and provide some guidance on how to navigate these complex issues.

It’s important to note that the tax treatment of slip and fall settlements can vary depending on the circumstances of the case. Factors such as the type of damages awarded, the nature of the injury, and the source of the settlement funds can all impact the taxability of the settlement. Understanding these factors can help you make informed decisions about how to handle your slip and fall settlement. So, let’s dive in and explore this topic in more detail.

Yes, slip and fall settlements may be taxable, depending on the circumstances. If the settlement is for physical injuries, it is typically not taxable. However, if the settlement includes compensation for lost wages or emotional distress, it may be taxable. It is important to consult with a tax professional to determine the tax implications of a slip and fall settlement.

Contents

- Are Slip and Fall Settlements Taxable?

- Frequently Asked Questions

- What is a slip and fall settlement?

- What is the tax status of slip and fall settlements?

- What factors determine the taxability of a slip and fall settlement?

- Do I have to report a slip and fall settlement on my tax return?

- What should I do if I am unsure about the tax status of my slip and fall settlement?

Are Slip and Fall Settlements Taxable?

Slip and fall accidents can result in serious injuries, which can lead to significant medical expenses, lost wages, and pain and suffering. If you have been injured in a slip and fall accident, you may be entitled to compensation in the form of a settlement. However, you may be wondering whether or not that settlement is taxable. In this article, we will explore whether or not slip and fall settlements are taxable.

What is a slip and fall settlement?

A slip and fall settlement is a legal agreement reached between the injured party and the party responsible for the accident. This settlement is typically reached outside of court and is designed to compensate the injured party for their losses. Slip and fall settlements can be reached through negotiations or through mediation.

When a slip and fall settlement is reached, the injured party typically receives a lump sum payment or a series of payments to cover their medical expenses, lost wages, and other damages. However, it is important to understand whether or not this settlement is taxable.

Are slip and fall settlements taxable?

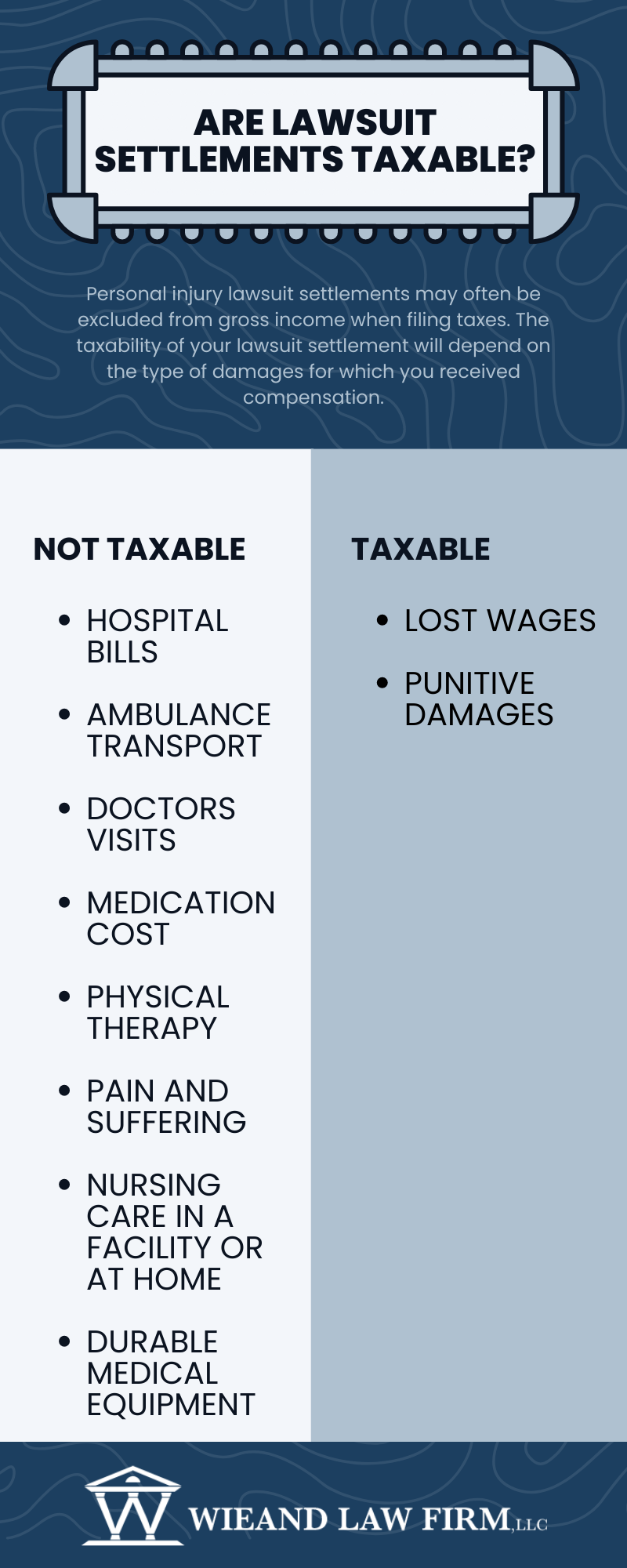

The answer to whether or not slip and fall settlements are taxable is: it depends. In general, the IRS considers compensation for physical injuries or sickness to be tax-free. However, compensation for emotional distress or mental anguish is taxable.

If your slip and fall settlement includes compensation for physical injuries or sickness, then that portion of the settlement is not taxable. However, if your settlement includes compensation for emotional distress or mental anguish, then that portion of the settlement is taxable.

Other factors that can affect the taxability of slip and fall settlements

In addition to compensation for physical injuries or sickness and emotional distress or mental anguish, there are other factors that can affect the taxability of slip and fall settlements. These factors include:

- The type of damages awarded in the settlement (e.g. lost wages, medical expenses, pain and suffering)

- The tax bracket of the recipient

- The specific circumstances of the case

It is important to consult with a tax professional to determine the taxability of your slip and fall settlement.

Benefits of hiring a personal injury lawyer

If you have been injured in a slip and fall accident, it is important to hire a personal injury lawyer to help you navigate the legal process. A personal injury lawyer can help you:

- Determine the value of your case

- Negotiate with insurance companies and other parties

- File a lawsuit if necessary

- Maximize your compensation

By hiring a personal injury lawyer, you can ensure that your rights are protected and that you receive the compensation that you are entitled to.

Slip and fall settlements vs jury verdicts

In some slip and fall cases, a settlement may be reached outside of court. In other cases, the case may go to trial and a jury verdict may be reached. There are pros and cons to both slip and fall settlements and jury verdicts.

Slip and fall settlements are often reached more quickly than jury verdicts and can help the injured party avoid the stress and uncertainty of a trial. However, settlements may result in a lower compensation amount than a jury verdict.

Jury verdicts, on the other hand, can result in higher compensation amounts, but can also take longer to reach and may be subject to appeal.

Conclusion

In conclusion, slip and fall settlements may or may not be taxable, depending on the specific circumstances of the case. It is important to consult with a tax professional to determine the taxability of your settlement. If you have been injured in a slip and fall accident, it is important to hire a personal injury lawyer to help you navigate the legal process and maximize your compensation.

Frequently Asked Questions

What is a slip and fall settlement?

A slip and fall settlement is a legal agreement between the plaintiff (injured person) and defendant (the party responsible for the accident) to compensate the plaintiff for any injuries sustained in a slip and fall accident. The settlement amount is typically determined by the extent of the injuries, medical expenses, lost wages, and other factors.

What is the tax status of slip and fall settlements?

Slip and fall settlements may or may not be taxable, depending on the nature of the settlement. If the settlement is awarded for physical injuries or illnesses, it is usually tax-free. However, if the settlement includes compensation for lost wages, emotional distress, or punitive damages, it may be subject to taxation. It is important to consult with a tax professional to determine the tax implications of your settlement.

What factors determine the taxability of a slip and fall settlement?

The taxability of a slip and fall settlement depends on several factors, including the nature of the settlement, the type of damages awarded, and the tax laws in your state. Generally, settlements awarded for physical injuries or illnesses are tax-free, while settlements for lost wages, emotional distress, or punitive damages may be taxable. A tax professional can help you determine the tax implications of your settlement.

Do I have to report a slip and fall settlement on my tax return?

If your slip and fall settlement is taxable, you must report it on your tax return. The settlement amount should be included on your Form 1040 under “Other Income.” If your settlement is tax-free, you do not need to report it on your tax return.

What should I do if I am unsure about the tax status of my slip and fall settlement?

If you are unsure about the tax status of your slip and fall settlement, it is important to consult with a tax professional. They can help you determine whether your settlement is taxable, and if so, how much you may owe in taxes. It is better to be safe than sorry when it comes to taxes, so don’t hesitate to seek professional advice.

In conclusion, it is important to understand the tax implications of slip and fall settlements. While the settlement amount itself is not taxable, any interest earned on the settlement may be subject to taxes. Additionally, if the settlement includes compensation for lost wages or medical expenses, it is important to consult with a tax professional to determine how to properly report these amounts on your tax return.

It is also important to note that the tax laws surrounding settlements can be complex and vary depending on the specific circumstances of your case. Therefore, it is always a good idea to consult with a lawyer and/or tax professional before accepting any settlement offer.

In the end, the key takeaway is to be informed and prepared when it comes to the tax implications of slip and fall settlements. With the right guidance and knowledge, you can ensure that you are not caught off guard by unexpected tax bills or penalties.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts