A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Getting into a car accident can be an incredibly stressful experience, especially when it comes to dealing with insurance companies. It’s essential to know how to handle the situation and protect your rights. In this article, we’ll share seven tips for dealing with insurance companies after a car accident, so you can navigate the process with confidence and ease. From gathering evidence to negotiating a settlement, we’ve got you covered. So, let’s dive in and learn how to handle insurance companies like a pro!

Dealing with insurance companies after a car accident can be overwhelming. Here are 7 tips to help you navigate the process: 1. Report the accident promptly. 2. Gather all necessary information. 3. Don’t admit fault. 4. Be wary of early settlement offers. 5. Keep track of all expenses. 6. Consider hiring an attorney. 7. Be patient and persistent.

7 Tips for Dealing with Insurance Companies After a Car Accident

If you’ve been in a car accident, dealing with insurance companies can be a major headache. The process can be confusing and stressful, and it’s important to know what steps to take to protect yourself and your interests. Here are seven tips to help you navigate the process of dealing with insurance companies after a car accident.

1. Report the Accident as Soon as Possible

The first step in dealing with insurance companies after a car accident is to report the accident as soon as possible. You should contact your own insurance company and the other driver’s insurance company to report the accident and provide all necessary information. This will help ensure that your claim is processed quickly and accurately.

It’s important to be honest and accurate when reporting the accident. Don’t exaggerate or downplay the extent of the damage or injuries. Provide all relevant details, including the date, time, location, and circumstances of the accident.

If you’re injured in the accident, make sure to seek medical attention right away. This will help ensure that your injuries are documented and treated, and that you have a record of your medical expenses.

2. Keep Detailed Records

Dealing with insurance companies after a car accident can involve a lot of paperwork and documentation. It’s important to keep detailed records of all communications, including phone calls, emails, and letters.

You should also keep track of all expenses related to the accident, including medical bills, car repairs, and rental car costs. This will help you document your losses and expenses and provide evidence to support your claim.

3. Be Careful What You Say

When dealing with insurance companies after a car accident, it’s important to be careful what you say. Insurance companies may use anything you say against you in order to deny or minimize your claim.

Don’t admit fault or apologize for the accident, even if you think you may have been at fault. Stick to the facts and avoid speculating or making assumptions.

4. Don’t Sign Anything Without Reviewing It

Insurance companies may ask you to sign documents or agreements related to your claim. It’s important to review these documents carefully and make sure you understand what you’re signing.

Don’t sign anything that you’re not comfortable with or that you don’t understand. If you have any questions or concerns, consult with an attorney or a trusted advisor before signing.

5. Be Prepared for a Long Process

Dealing with insurance companies after a car accident can be a long and frustrating process. Insurance companies may drag their feet when it comes to processing claims, and may try to minimize your claim in order to save money.

Be prepared for a long process and don’t be afraid to follow up with the insurance company on a regular basis. Keep track of all communications and make sure to provide any additional information or documentation as requested.

6. Consider Hiring an Attorney

If you’re having trouble dealing with insurance companies after a car accident, or if you feel like you’re not being treated fairly, consider hiring an attorney. An attorney can help you navigate the process and protect your rights.

An attorney can also help you negotiate with the insurance company and ensure that you receive the compensation you deserve. If your claim is denied or if you’re not satisfied with the settlement offer, an attorney can also help you file a lawsuit and take your case to court.

7. Know Your Rights

When dealing with insurance companies after a car accident, it’s important to know your rights. You have the right to be treated fairly and to receive compensation for your losses and expenses.

You also have the right to file a complaint with your state’s insurance department if you feel like you’re not being treated fairly. Make sure to research your rights and obligations and consult with an attorney or a trusted advisor if you have any questions or concerns.

In conclusion, dealing with insurance companies after a car accident can be stressful and confusing. But by following these seven tips, you can protect yourself and ensure that you receive the compensation you deserve. Remember to report the accident as soon as possible, keep detailed records, be careful what you say, don’t sign anything without reviewing it, be prepared for a long process, consider hiring an attorney, and know your rights.

Frequently Asked Questions

Here are some common questions people have when dealing with insurance companies after a car accident.

What should I do first after a car accident?

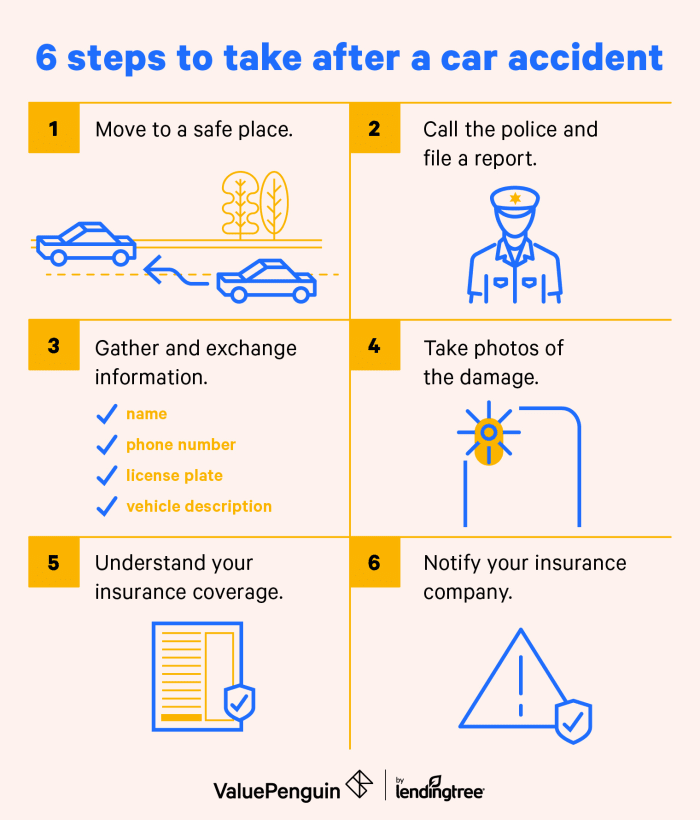

First and foremost, make sure everyone involved in the accident is safe and call emergency services if necessary. Exchange contact and insurance information with the other driver(s) involved and gather evidence such as photos and witness statements. It’s important to report the accident to your insurance company as soon as possible, even if you are not at fault.

When speaking with your insurance company, be honest and provide as much detail as possible about the accident. Avoid accepting fault or making any statements that could be interpreted as an admission of guilt. Your insurance company will likely assign an adjuster to your case, who will help guide you through the claims process.

What if the other driver’s insurance company contacts me?

If the other driver’s insurance company contacts you, it’s important to be cautious and not provide any unnecessary information. They may try to get you to admit fault or downplay the severity of your injuries. You are not obligated to speak with the other driver’s insurance company, and it may be in your best interest to have your own insurance company handle the communication. If you do choose to speak with the other driver’s insurance company, be sure to document everything and consult with your own insurance company before accepting any settlements or offers.

Remember that the other driver’s insurance company is not on your side and their goal is to pay out as little money as possible. Stick to the facts and do not speculate or make assumptions about the accident or your injuries.

What if my insurance company denies my claim?

If your insurance company denies your claim, it’s important to find out why and review your policy to see if the denial is valid. You may need to provide additional evidence or consult with a lawyer to dispute the denial. If you are not satisfied with your insurance company’s handling of your claim, you may also file a complaint with your state’s insurance department.

Keep in mind that insurance companies are for-profit businesses and it’s not uncommon for them to deny claims in order to save money. However, if you believe your claim was unjustly denied, it’s important to take action to protect your rights and seek the compensation you deserve.

How long does it take to settle a car accident claim?

The length of time it takes to settle a car accident claim can vary depending on the complexity of the case and the cooperation of the involved parties. In general, it can take anywhere from a few weeks to several months or even years to reach a settlement. Your insurance company will work with you to gather evidence, assess damages, and negotiate a settlement with the other driver’s insurance company.

If you are not satisfied with the settlement offer, you may choose to file a lawsuit or continue negotiating with the insurance companies. Keep in mind that the longer the case drags on, the more stressful and costly it can become, so it’s important to work towards a fair and timely resolution.

What if I am partially at fault for the accident?

If you are partially at fault for the accident, it can complicate the claims process and affect the amount of compensation you receive. In some states, if you are found to be more than 50% at fault for the accident, you may not be able to recover any damages at all.

If you are partially at fault, it’s important to cooperate with your insurance company and the other driver’s insurance company to reach a fair settlement. Your insurance company will likely assign a percentage of fault to each driver and adjust the settlement accordingly. If you disagree with the percentage of fault assigned to you, you may need to consult with a lawyer or file a dispute with your state’s insurance department.

In conclusion, dealing with insurance companies after a car accident can be a frustrating and overwhelming experience. However, by following the tips outlined in this article, you can increase your chances of receiving a fair settlement and minimizing stress. Remember to document everything, communicate clearly and assertively, and seek legal advice if necessary.

By staying organized and keeping track of important information, you can build a strong case and negotiate effectively with insurance adjusters. Don’t hesitate to ask questions and request clarification, and be persistent in your efforts to reach a satisfactory resolution. With patience and persistence, you can navigate the complex world of insurance claims and emerge with a favorable outcome.

In the end, the most important thing is to take care of yourself and your loved ones after a car accident. Don’t let the insurance company add to your stress and anxiety. Use these tips to protect your rights and get the compensation you deserve. With the right mindset and approach, you can move forward from this difficult experience and focus on healing and recovery.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts