A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Florida is known for its beautiful beaches, theme parks, and sunny weather. However, with millions of drivers on the road, accidents are bound to happen. That’s where Personal Injury Protection (PIP) comes into play.

But is PIP required in Florida? The answer is yes, and in this article, we’ll dive into what PIP is, how it works, and what it means for drivers in the Sunshine State. So buckle up and let’s get started!

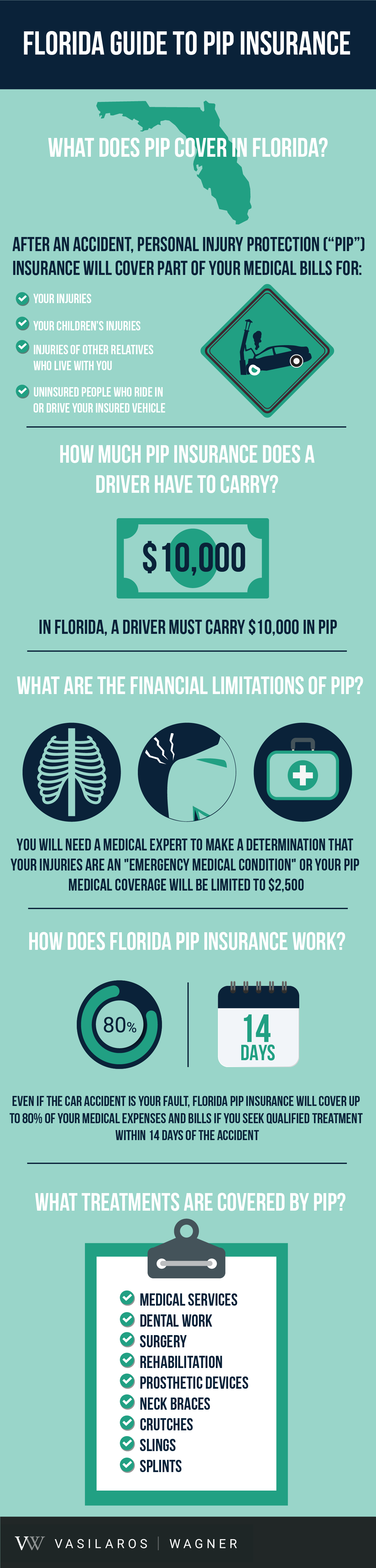

Personal Injury Protection (PIP) is required in Florida. It covers medical expenses, lost wages, and other related expenses in case of an accident, regardless of who is at fault. The minimum PIP coverage requirement in Florida is $10,000. Failure to maintain PIP coverage can result in the suspension of your driver’s license and vehicle registration.

Is Personal Injury Protection Required in Florida?

Personal injury protection, or PIP, is an essential part of auto insurance in Florida. It is mandatory in the state, and drivers are required to carry a minimum of $10,000 in PIP coverage. But what exactly is PIP, and why is it necessary? In this article, we’ll explore the ins and outs of PIP insurance and answer some common questions about its requirements in Florida.

What is Personal Injury Protection?

Personal injury protection, or PIP, is a type of auto insurance coverage that pays for medical expenses and lost wages if you or your passengers are injured in a car accident. It’s also known as “no-fault” insurance because it pays out regardless of who was at fault for the accident. PIP insurance is required in Florida, as well as in several other states.

How Does PIP Coverage Work?

If you’re involved in a car accident in Florida, your PIP coverage will kick in to pay for medical expenses and lost wages for you and your passengers, up to the limits of your policy. This coverage applies regardless of who was at fault for the accident. However, if the other driver was at fault and you have additional medical expenses or lost wages beyond your PIP coverage, you may be able to file a claim against their insurance policy.

What Does PIP Cover?

PIP insurance covers a range of expenses related to injuries sustained in a car accident. This can include medical expenses such as hospital bills, doctor visits, and rehabilitation costs. PIP also covers lost wages if you are unable to work due to your injuries. Additionally, PIP can cover other expenses such as funeral costs and replacement services if you are unable to perform household tasks due to your injuries.

Why is PIP Required in Florida?

PIP insurance is required in Florida as part of the state’s no-fault insurance system. This means that regardless of who was at fault for an accident, each driver’s insurance policy will pay for their own medical expenses and lost wages. The no-fault system was designed to reduce the number of lawsuits related to car accidents and provide faster and more efficient compensation to those who are injured.

What are the Benefits of PIP Insurance?

There are several benefits to carrying PIP insurance in Florida. First and foremost, it provides you with peace of mind knowing that you and your passengers will be covered in the event of an accident. Additionally, PIP insurance can provide faster compensation for medical expenses and lost wages compared to filing a lawsuit. PIP also helps to reduce the number of lawsuits related to car accidents, which can benefit all drivers by keeping insurance premiums lower.

What are the Downsides of PIP Insurance?

One potential downside of PIP insurance is that it can be expensive, especially if you have a high-risk driving record or have been involved in accidents before. Additionally, PIP insurance only covers a limited amount of medical expenses and lost wages, so if you have significant injuries or lost wages, you may need to file a claim against the other driver’s insurance policy to receive full compensation.

PIP vs. Bodily Injury Liability Coverage

In addition to PIP insurance, Florida drivers are also required to carry bodily injury liability coverage. Bodily injury liability coverage pays for medical expenses and other damages if you are at fault for an accident and injure someone else. While PIP covers your own medical expenses and lost wages, bodily injury liability coverage covers the medical expenses and other damages of others if you are at fault.

How Much Bodily Injury Liability Coverage is Required in Florida?

In Florida, drivers are required to carry a minimum of $10,000 in bodily injury liability coverage per person and $20,000 per accident. However, it’s recommended that drivers carry more than the minimum coverage to provide better protection in the event of a serious accident.

Should You Carry PIP and Bodily Injury Liability Coverage?

Carrying both PIP and bodily injury liability coverage is recommended for all Florida drivers. PIP provides coverage for your own medical expenses and lost wages, while bodily injury liability coverage provides coverage for others if you are at fault for an accident. Together, these two types of coverage can provide comprehensive protection in the event of a car accident.

Conclusion

In conclusion, personal injury protection, or PIP, is required in Florida as part of the state’s no-fault insurance system. PIP provides coverage for medical expenses and lost wages if you or your passengers are injured in a car accident, regardless of who was at fault. While PIP can be expensive, it provides peace of mind and can provide faster compensation compared to filing a lawsuit. Additionally, carrying both PIP and bodily injury liability coverage is recommended for all Florida drivers to provide comprehensive protection in the event of an accident.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) coverage?

- What does PIP coverage in Florida include?

- What are the benefits of having PIP coverage in Florida?

- Is PIP coverage required in Florida if I have health insurance?

- What happens if I don’t have PIP coverage in Florida?

- Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

Frequently Asked Questions

What is Personal Injury Protection (PIP) coverage?

Personal Injury Protection (PIP) coverage is a type of car insurance that covers medical expenses and lost wages for you and your passengers in the event of an accident, regardless of who is at fault. It is also known as no-fault insurance.

In Florida, PIP coverage is required by law for all drivers who own a registered vehicle, with a minimum coverage of $10,000 for medical expenses and $5,000 for death benefits.

What does PIP coverage in Florida include?

PIP coverage in Florida includes medical expenses, lost wages, and death benefits. Medical expenses include hospitalization, surgery, and rehabilitation costs. Lost wages cover the income that you would have earned if you were not injured and unable to work. Death benefits cover the funeral and burial expenses of a person who died in a car accident.

PIP coverage also provides benefits for necessary medical services such as X-rays, MRI, and other diagnostic tests. It may also cover chiropractic care and acupuncture, along with other treatments that are deemed medically necessary.

What are the benefits of having PIP coverage in Florida?

The benefits of having PIP coverage in Florida include having your medical expenses and lost wages covered if you are involved in an accident, regardless of who is at fault. This can help you avoid expensive medical bills and financial hardship due to lost income. PIP coverage can also provide peace of mind knowing that you and your passengers are covered in the event of an accident.

Additionally, PIP coverage in Florida can help reduce the number of lawsuits resulting from car accidents, as it limits the right to sue for non-economic damages unless the injuries are considered to be serious or permanent.

Is PIP coverage required in Florida if I have health insurance?

Yes, PIP coverage is still required in Florida even if you have health insurance. This is because PIP coverage provides benefits that are not covered by standard health insurance policies, such as lost wages and death benefits. Additionally, PIP coverage is designed to provide immediate coverage for medical expenses and lost wages, while health insurance may require extensive paperwork and delays.

However, if you have health insurance that meets the minimum requirements set by Florida law, you may be eligible for a PIP exemption. To qualify for a PIP exemption, you must submit a written request to your insurance provider and provide proof of your health insurance coverage.

What happens if I don’t have PIP coverage in Florida?

If you don’t have PIP coverage in Florida, you may face legal and financial consequences in the event of an accident. You may be responsible for paying for your own medical expenses and lost wages, as well as those of your passengers. You may also face fines and penalties for driving without insurance.

Additionally, if you are injured in an accident and do not have PIP coverage, you may have limited options for seeking compensation from the other driver’s insurance company. This can result in lengthy legal battles and financial hardship.

Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

In conclusion, the answer to whether Personal Injury Protection (PIP) is required in Florida is a resounding yes. As a no-fault state, Florida requires all drivers to carry PIP insurance coverage to ensure that they are protected in the event of an accident. The benefits of PIP coverage include medical expenses, lost wages, and death benefits, which provide peace of mind for both drivers and passengers.

While PIP coverage may increase the cost of car insurance, it is important to remember that it is a legal requirement in Florida. Failure to carry PIP coverage could result in fines and legal penalties, as well as leaving you vulnerable to the financial consequences of an accident. Therefore, it is important to prioritize PIP coverage when selecting your car insurance policy to ensure that you are fully protected.

Overall, PIP coverage is an essential component of car insurance in Florida. By understanding the requirements and benefits of this coverage, drivers can make informed decisions when selecting their insurance policies, ultimately leading to greater peace of mind on the road.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts