A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Personal injury protection (PIP) is a type of insurance coverage that covers medical expenses and lost wages resulting from an accident. While PIP is not required in every state, it is a valuable form of coverage that can provide financial protection in the event of an accident. If you’re wondering whether you need additional PIP coverage, this article will explore the benefits of PIP insurance and help you determine whether it’s the right choice for you.

Whether you’re a seasoned driver or a new one, accidents can happen to anyone. Injuries sustained in a car accident can be costly, and without proper insurance coverage, you could be left with a hefty bill. PIP insurance can help alleviate the financial burden of medical bills and lost wages, making it a smart choice for many drivers. Read on to learn more about PIP coverage and whether it’s the right choice for your needs.

Additional personal injury protection can be beneficial if you frequently drive on busy roads or have a long commute. This coverage can help cover medical expenses and lost wages if you are injured in an accident. However, if you have good health insurance and disability coverage, you may not need additional personal injury protection. Review your current coverage and consider your individual needs before making a decision.

Do I Need Additional Personal Injury Protection?

Personal injury protection (PIP) is a type of car insurance that covers medical expenses and lost wages in case of an accident. Most states require drivers to have a minimum amount of PIP coverage, but you may be wondering if you need additional PIP coverage. In this article, we will explore the question of whether you need additional PIP coverage.

What is Personal Injury Protection?

Personal injury protection, also known as no-fault insurance, is a type of car insurance that covers medical expenses and lost wages in case of an accident. PIP is designed to provide coverage regardless of who was at fault for the accident. This means that even if you caused the accident, your PIP coverage will still pay for your medical expenses and lost wages.

Most states require drivers to have a minimum amount of PIP coverage, but the amount of coverage required varies from state to state. In some states, PIP coverage is optional.

Do I Need Additional PIP Coverage?

Whether or not you need additional PIP coverage depends on a few factors, including your health insurance coverage, your employment situation, and your financial situation.

If you have comprehensive health insurance that covers medical expenses in case of an accident, you may not need additional PIP coverage. However, if your health insurance has high deductibles or copays, PIP coverage can help cover those costs.

If you are self-employed or work in a job that does not provide paid sick leave, you may want to consider additional PIP coverage to cover lost wages in case of an accident.

If you have a high net worth and are concerned about being sued for damages in case of an accident, additional PIP coverage can help protect your assets.

Benefits of Additional PIP Coverage

Additional PIP coverage can provide several benefits, including:

– Coverage for medical expenses and lost wages beyond the minimum required by your state

– Coverage for deductibles and copays not covered by your health insurance

– Coverage for lost wages if you are self-employed or your employer does not provide paid sick leave

– Protection for your assets in case of a lawsuit

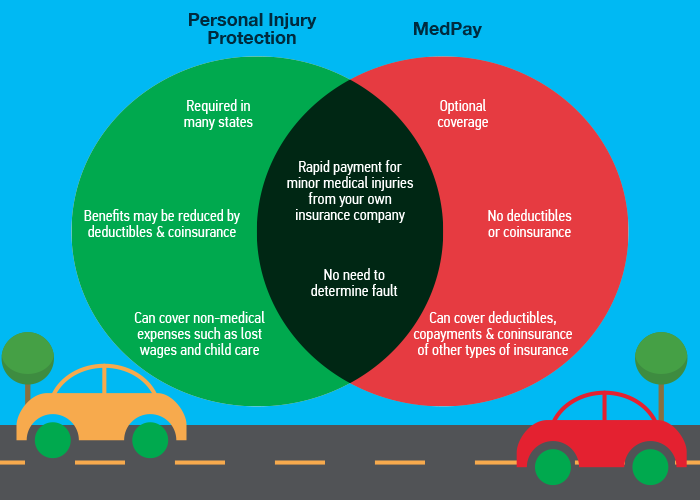

PIP Coverage vs. Medical Payments Coverage

Medical payments coverage is another type of car insurance that covers medical expenses in case of an accident. Unlike PIP coverage, medical payments coverage only covers medical expenses and does not cover lost wages.

If you have comprehensive health insurance that covers medical expenses, you may not need medical payments coverage. However, if your health insurance has high deductibles or copays, medical payments coverage can help cover those costs.

PIP Coverage vs. Bodily Injury Liability Coverage

Bodily injury liability coverage is a type of car insurance that covers injuries to other people if you are at fault for an accident. Unlike PIP coverage, bodily injury liability coverage does not cover your own medical expenses or lost wages.

If you have comprehensive health insurance and are not concerned about being sued for damages, you may not need additional bodily injury liability coverage. However, if you have a high net worth and are concerned about being sued for damages, additional bodily injury liability coverage can help protect your assets.

How Much Additional PIP Coverage Do I Need?

The amount of additional PIP coverage you need depends on your individual situation. If you have comprehensive health insurance and are not concerned about lost wages, you may not need additional PIP coverage.

However, if you have high deductibles or copays, are self-employed or do not receive paid sick leave, or are concerned about being sued for damages, you may want to consider additional PIP coverage.

How Much Does Additional PIP Coverage Cost?

The cost of additional PIP coverage varies depending on the amount of coverage you need and your individual situation. However, additional PIP coverage is typically affordable and can provide valuable protection in case of an accident.

Conclusion

In conclusion, whether or not you need additional PIP coverage depends on your individual situation. If you have comprehensive health insurance and are not concerned about lost wages, you may not need additional PIP coverage. However, if you have high deductibles or copays, are self-employed or do not receive paid sick leave, or are concerned about being sued for damages, you may want to consider additional PIP coverage. Additional PIP coverage can provide valuable protection in case of an accident and is typically affordable.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) coverage?

- How much PIP coverage do I need?

- Do I need additional PIP coverage if I already have health insurance?

- What are the benefits of having PIP coverage?

- How can I add PIP coverage to my car insurance policy?

- Do I Need Personal Injury Protection (PIP) If I Have Health Insurance?

Frequently Asked Questions

What is Personal Injury Protection (PIP) coverage?

Personal Injury Protection (PIP) coverage is a type of car insurance that covers medical expenses and lost wages if you or your passengers are injured in a car accident. PIP coverage is also known as “no-fault” insurance because it pays out regardless of who caused the accident.

In some states, PIP coverage is mandatory, but in others, it is optional. If you live in a state where PIP coverage is optional, you may want to consider adding it to your car insurance policy to protect yourself and your passengers in the event of an accident.

How much PIP coverage do I need?

The amount of PIP coverage you need depends on your individual circumstances. In general, you should consider your medical expenses and lost wages if you or your passengers are injured in a car accident. You should also consider any other expenses you may incur as a result of the accident, such as childcare or housekeeping services.

Most insurance companies offer PIP coverage with limits ranging from $10,000 to $100,000. You should choose a limit that will cover your expenses in the event of an accident. Keep in mind that higher limits may result in higher premiums.

Do I need additional PIP coverage if I already have health insurance?

If you already have health insurance, you may wonder if you need additional PIP coverage. While health insurance can cover your medical expenses, it may not cover all of the expenses associated with a car accident, such as lost wages or childcare services.

Adding PIP coverage to your car insurance policy can provide additional protection in the event of an accident. PIP coverage can help cover your medical expenses and lost wages, as well as other expenses you may incur as a result of the accident.

What are the benefits of having PIP coverage?

There are several benefits to having PIP coverage, including peace of mind and financial protection. PIP coverage can help cover your medical expenses and lost wages if you or your passengers are injured in a car accident, which can help alleviate the financial burden of an accident.

PIP coverage can also provide additional benefits, such as coverage for rehabilitation services, funeral expenses, and even legal fees. Adding PIP coverage to your car insurance policy can provide you with additional protection and peace of mind in the event of an accident.

How can I add PIP coverage to my car insurance policy?

Adding PIP coverage to your car insurance policy is easy. Simply contact your insurance company and request to add PIP coverage to your policy. Your insurance company will provide you with information on the coverage options available to you and the cost of adding PIP coverage to your policy.

Keep in mind that adding PIP coverage to your car insurance policy may result in an increase in your premiums. However, the added protection and peace of mind may be worth the additional cost.

Do I Need Personal Injury Protection (PIP) If I Have Health Insurance?

In conclusion, the decision to purchase additional personal injury protection (PIP) ultimately depends on your individual needs and circumstances. If you have adequate health insurance coverage and feel comfortable with the minimum PIP required by your state, then you may not need to purchase additional coverage. However, if you frequently drive in high-risk areas or have a job that puts you at greater risk of injury, additional PIP coverage could provide valuable protection.

It’s essential to carefully consider your options and evaluate the potential benefits and drawbacks of additional PIP coverage before making a decision. Consulting with an experienced insurance agent can help you understand your options and make an informed decision that provides the most protection for your unique needs. Remember, protecting yourself and your loved ones is always a top priority, and additional PIP coverage could be a valuable investment in your peace of mind and financial security.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts