A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Montana is a beautiful state known for its stunning natural landscapes, rugged mountains, and vast wilderness areas. But despite its natural beauty, accidents can and do happen, and when they do, it’s essential to know what your legal rights are. One of the most common questions people ask is whether Personal Injury Protection (PIP) is required in Montana. In this article, we will explore the answer to this question and provide you with the information you need to protect yourself in the event of an accident.

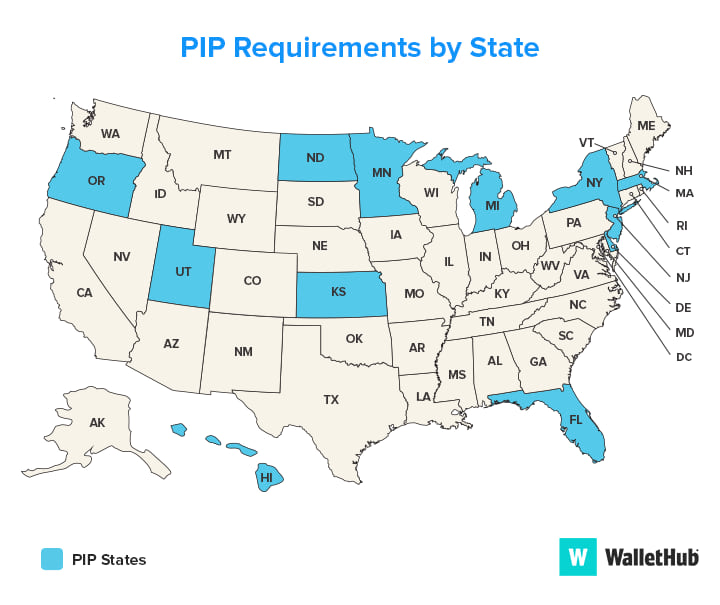

Personal Injury Protection is a type of insurance that provides coverage for medical expenses, lost wages, and other expenses related to an accident. While PIP is mandatory in some states, Montana is not one of them. However, just because PIP is not required by law doesn’t mean you shouldn’t consider getting it. In fact, PIP can be a valuable asset in protecting you and your loved ones from the financial fallout of an accident. So, let’s dive into the details and find out more about PIP in Montana.

Yes, Personal Injury Protection (PIP) is required in Montana. It is mandatory for all registered vehicles to have at least $25,000 per person and $50,000 per accident in PIP coverage. PIP coverage provides medical expenses, lost wages, and other related expenses regardless of who is at fault in an accident. Failure to carry PIP coverage can result in fines and legal consequences.

Is Personal Injury Protection Required in Montana?

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of insurance coverage that pays for medical expenses and lost wages in case of an accident. PIP coverage is mandatory in some states, but not all. Montana is one of the few states that does not require PIP coverage for drivers.

PIP coverage is designed to provide immediate medical coverage and wage loss benefits for the driver and passengers involved in an accident, regardless of who is at fault. The insurance company will pay the expenses up to the policy limit, and the insured party can choose to sue the at-fault driver for any additional damages beyond the policy limit.

Why is PIP Not Required in Montana?

Montana is an at-fault state, which means that the driver who is found to be at fault for the accident is responsible for paying for the damages. In at-fault states, PIP coverage is not required because the at-fault driver’s insurance company is responsible for paying for the damages.

Additionally, Montana has a low population density and a lower number of accidents compared to other states. The state government has not deemed it necessary to require PIP coverage for drivers in Montana.

Benefits of Having PIP Coverage in Montana

Even though PIP coverage is not required in Montana, drivers can still benefit from having this coverage. PIP coverage can provide peace of mind knowing that medical expenses and lost wages will be covered in case of an accident. This coverage can also help to reduce out-of-pocket expenses, especially if the driver has a high deductible on their health insurance policy.

Another benefit of having PIP coverage is that it can provide additional coverage for passengers in the vehicle. If a passenger is injured in an accident, PIP coverage can help to pay for their medical expenses and lost wages.

PIP Coverage Vs. Medical Payments Coverage

While PIP coverage is not required in Montana, drivers can still choose to purchase Medical Payments (MedPay) coverage. MedPay coverage is similar to PIP coverage in that it pays for medical expenses for the driver and passengers involved in an accident, regardless of who is at fault.

However, there are some differences between PIP and MedPay coverage. PIP coverage typically provides more comprehensive coverage than MedPay, including coverage for lost wages and other expenses. PIP coverage also has higher policy limits than MedPay coverage, which can be beneficial for drivers who have high medical expenses.

Conclusion

In conclusion, PIP coverage is not required in Montana for drivers, but it can still be a beneficial coverage option to consider. PIP coverage can provide immediate medical coverage and wage loss benefits for drivers and passengers involved in an accident, regardless of who is at fault. Drivers can also choose to purchase MedPay coverage, which is similar to PIP coverage but with some differences in coverage and policy limits. Ultimately, it is up to each driver to determine what type of insurance coverage is best for them and their individual needs.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP)?

- What is the Minimum Liability Coverage Required in Montana?

- What Happens if I Don’t Have Insurance in Montana?

- What Should I Consider When Choosing Car Insurance in Montana?

- How Can I Lower My Car Insurance Premium in Montana?

- What is Personal Injury Protection (PIP)?

Frequently Asked Questions

Montana is a state that requires motorists to have a minimum amount of liability coverage. However, personal injury protection (PIP) is not mandatory in Montana.

What is Personal Injury Protection (PIP)?

Personal injury protection (PIP) is a type of car insurance that covers medical expenses and lost wages for you and your passengers in the event of an accident, regardless of who is at fault. PIP is often referred to as “no-fault” insurance because it pays out regardless of who caused the accident.

In Montana, PIP coverage is optional. If you choose to purchase PIP coverage, it can provide additional benefits beyond what your health insurance policy covers, such as compensation for lost wages and household services.

What is the Minimum Liability Coverage Required in Montana?

In Montana, the minimum liability coverage required is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage per accident. This means that if you are at fault for an accident, your insurance will pay up to these amounts to cover the other party’s medical expenses and property damage.

Keep in mind that these are only the minimum requirements, and you may want to consider purchasing additional coverage to protect yourself in the event of a serious accident.

What Happens if I Don’t Have Insurance in Montana?

If you are caught driving without insurance in Montana, you could face serious consequences. The first offense carries a fine of up to $500 and up to 10 days in jail. Subsequent offenses carry steeper fines and longer jail sentences. Additionally, your driver’s license and registration could be suspended, and you may be required to file an SR-22 form in order to reinstate your driving privileges.

Driving without insurance is not only illegal but also puts you at risk of having to pay out of pocket for any damages or injuries you cause in an accident.

What Should I Consider When Choosing Car Insurance in Montana?

When choosing car insurance in Montana, there are several factors to consider. First and foremost, you should make sure that you have the minimum liability coverage required by law. Beyond that, you may want to consider purchasing additional coverage for things like PIP, uninsured motorist coverage, and comprehensive and collision coverage.

You should also compare rates from multiple insurance providers to ensure that you are getting the best possible price for the coverage you need. Additionally, you may want to consider factors like customer service ratings and online tools and resources when choosing an insurance company.

How Can I Lower My Car Insurance Premium in Montana?

There are several things you can do to lower your car insurance premium in Montana. First, consider raising your deductible, which is the amount you pay out of pocket before your insurance kicks in. Increasing your deductible can lower your monthly premium, but it also means that you will have to pay more out of pocket in the event of an accident.

You may also be able to lower your premium by taking advantage of discounts offered by your insurance company. For example, you may be eligible for a discount if you have a good driving record, bundle your car insurance with other types of insurance, or complete a defensive driving course.

What is Personal Injury Protection (PIP)?

In conclusion, knowing whether or not Personal Injury Protection (PIP) is required in Montana is crucial for anyone living, working, or driving in the state. While it may not be mandatory, having PIP coverage can provide financial protection and peace of mind in the event of an accident.

Additionally, it’s important to note that Montana is an at-fault state, meaning that the driver at fault in an accident is responsible for any resulting damages or injuries. Without PIP coverage, drivers may be left with significant medical bills and other expenses if they are found to be at fault in an accident.

Ultimately, the decision to purchase PIP coverage is up to the individual driver. However, it’s recommended that anyone who frequently drives in Montana consider adding this coverage to their auto insurance policy to ensure they are fully protected in the event of an accident.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts