A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Personal injury protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages in the event of an accident. In Oregon, PIP is mandatory for all drivers, but many people are still unaware of this requirement.

With the rising number of accidents on the roads, it is essential to understand the importance of PIP and its legal requirement in Oregon. In this article, we will explore the details of PIP insurance and how it can protect you and your loved ones in case of an accident. Let us delve deeper into this topic and unravel the mystery surrounding the mandatory PIP insurance in Oregon.

Yes, Personal Injury Protection (PIP) is required in Oregon. It is mandatory for all Oregon drivers to carry a minimum of $15,000 PIP coverage per person per accident. PIP coverage provides medical expenses, lost wages, and other related expenses in case of an accident, regardless of who is at fault.

Is Personal Injury Protection Required in Oregon?

Understanding Personal Injury Protection (PIP)

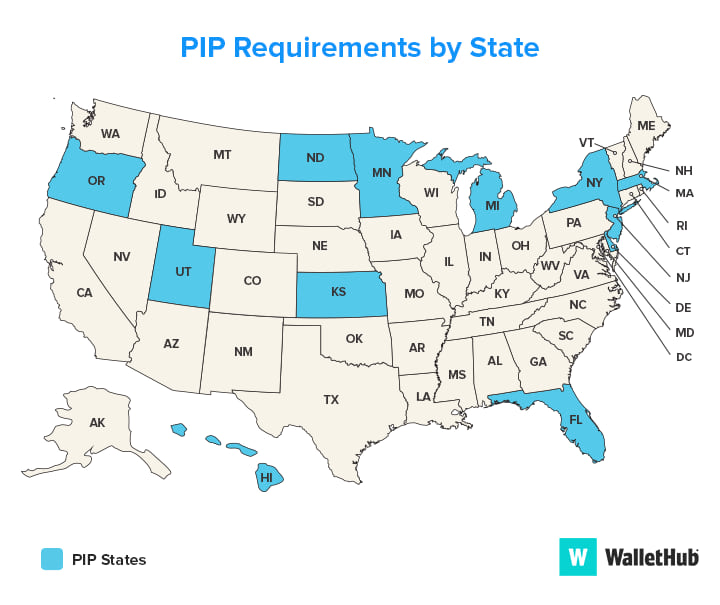

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages for drivers and passengers involved in an accident, regardless of who is at fault. PIP insurance is mandatory in some states, while others offer it as an optional add-on to car insurance policies.

What Does PIP Insurance Cover?

In Oregon, PIP insurance covers medical expenses, lost wages, and other related expenses resulting from a car accident. PIP coverage typically includes:

- Medical expenses, including hospital bills, doctor visits, and other medical treatments

- Lost wages due to time off work as a result of the accident

- Childcare expenses

- Funeral expenses

Who is Covered by PIP Insurance?

In Oregon, PIP insurance covers the driver and passengers in the insured vehicle, as well as pedestrians and bicyclists involved in an accident with the insured vehicle.

Is PIP Insurance Required in Oregon?

Yes, PIP Insurance is Mandatory in Oregon

In Oregon, all drivers must carry a minimum of $15,000 in PIP insurance coverage. This means that if you are involved in a car accident in Oregon, your PIP insurance will cover up to $15,000 of your medical expenses, lost wages, and other related expenses.

What Happens if You Don’t Have PIP Insurance?

If you are caught driving without PIP insurance in Oregon, you could face fines, license suspension, and other penalties. Additionally, if you are involved in a car accident and don’t have PIP insurance, you could be responsible for paying your own medical bills, lost wages, and other related expenses.

Benefits of PIP Insurance

- PIP insurance provides peace of mind knowing that you and your passengers will be covered in the event of a car accident, regardless of who is at fault.

- PIP insurance can help cover medical expenses and lost wages, which can be especially important if you are unable to work due to your injuries.

- PIP insurance can also help cover expenses related to childcare and funeral costs.

PIP Insurance vs. Health Insurance

While health insurance can provide coverage for medical expenses resulting from a car accident, it may not cover all of the expenses associated with an accident, such as lost wages and childcare costs. Additionally, health insurance may have deductibles and copayments that can add up quickly.

PIP insurance, on the other hand, provides coverage for a wide range of expenses related to a car accident, without deductibles or copayments. This can help ensure that you and your passengers get the care and support you need after an accident.

Conclusion

In summary, PIP insurance is mandatory in Oregon and provides important coverage for drivers and passengers involved in a car accident. If you are an Oregon driver, it is important to make sure you have the minimum required amount of PIP insurance coverage to protect yourself and your passengers in the event of an accident.

Frequently Asked Questions:

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of auto insurance that covers medical expenses and lost wages in the event of an accident. PIP is designed to provide coverage regardless of who caused the accident, and it is often referred to as “no-fault” insurance. PIP coverage may also include benefits such as funeral expenses and childcare expenses.

In Oregon, PIP coverage is required for all drivers. The minimum amount of PIP coverage required is $15,000 per person, per accident. However, drivers can choose to purchase additional PIP coverage if they wish.

What does PIP cover?

PIP coverage typically covers medical expenses, lost wages, and other expenses related to an accident. Medical expenses may include hospital bills, doctor’s visits, and rehabilitation costs. Lost wages may include income lost due to time off work to recover from injuries sustained in the accident. Other expenses that may be covered by PIP include funeral expenses and childcare expenses.

In Oregon, PIP coverage is required for all drivers. The minimum amount of PIP coverage required is $15,000 per person, per accident. However, drivers can choose to purchase additional PIP coverage if they wish.

Are there any exceptions to the PIP requirement in Oregon?

There are some exceptions to the PIP requirement in Oregon. For example, motorcycles are not required to have PIP coverage. Additionally, out-of-state drivers who are involved in accidents in Oregon may not be required to have PIP coverage, depending on their home state’s insurance requirements.

However, in general, PIP coverage is required for all drivers in Oregon. The minimum amount of PIP coverage required is $15,000 per person, per accident. Drivers can choose to purchase additional PIP coverage if they wish.

How does PIP coverage differ from liability coverage?

While PIP coverage is designed to cover medical expenses and lost wages for the policyholder, liability coverage is designed to cover damages and injuries sustained by other drivers or passengers in an accident. Liability coverage is typically required in addition to PIP coverage.

In Oregon, drivers are required to have both PIP coverage and liability coverage. The minimum liability coverage required is $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $20,000 for property damage per accident.

What happens if I don’t have PIP coverage in Oregon?

If you are caught driving without PIP coverage in Oregon, you may face penalties such as fines, license suspension, and even criminal charges. Additionally, if you are involved in an accident and do not have PIP coverage, you may be responsible for paying for your own medical expenses and lost wages, as well as the medical expenses and lost wages of any other drivers or passengers involved in the accident. It is always best to ensure that you have the required insurance coverage to avoid any legal or financial consequences.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is required in Oregon for all drivers. This is because PIP provides insurance coverage for medical expenses, lost wages, and other related costs in the event of an accident. Without PIP, drivers may face significant financial burdens that could potentially ruin their lives.

It is important to note that PIP insurance is not a one-size-fits-all solution. Drivers should carefully consider their individual needs and budget before purchasing a policy. Additionally, it is important to regularly review and update your coverage to ensure that it still meets your needs.

Overall, while PIP insurance may seem like an unnecessary expense, it is a crucial investment in your financial security and peace of mind. By purchasing a PIP policy, you can rest assured knowing that you and your loved ones are protected in the event of an accident or injury.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts