A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process....Read more

Arizona is a state that has a reputation for having some of the most complex car accident laws in the country. Many drivers are unsure of what to do in the event of a collision, and whether or not Arizona is a no-fault state is a common question.

In this article, we’ll explore whether or not Arizona is a no-fault state for car accidents, what that means for drivers, and what steps you should take if you’re involved in an accident. Whether you’re a seasoned driver or new to Arizona roads, this information is essential to understanding your rights and responsibilities as a motorist.

No, Arizona is not a no-fault state for car accidents. In Arizona, the driver who is found to be at-fault for the accident is responsible for paying for the damages and injuries of the other driver. Arizona follows a traditional tort system for car accidents.

Is Arizona a No Fault State for Car Accidents?

Understanding No-Fault Insurance

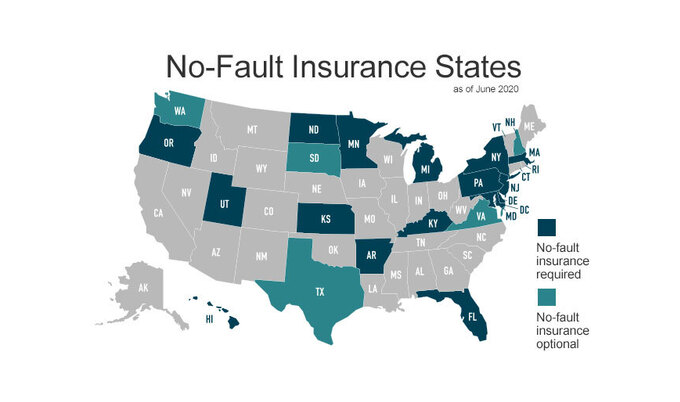

No-fault insurance is a type of car insurance where your insurance company pays for your damages regardless of who was at fault for the accident. The idea behind no-fault insurance is to reduce the number of lawsuits that result from car accidents. This type of insurance is mandatory in some states, while optional in others.

How No-Fault Insurance Works

In Arizona, there is no mandatory no-fault insurance law. What this means is that if you are involved in a car accident, the person who is at fault for the accident is responsible for paying for any damages or injuries that result from the accident. If you are the person who caused the accident, your insurance company will be responsible for paying for the other driver’s damages and injuries.

Benefits of No-Fault Insurance

One of the main benefits of no-fault insurance is that it can help reduce the number of lawsuits that result from car accidents. Because your insurance company pays for your damages regardless of who was at fault for the accident, there is less incentive for people to sue each other after a car accident. This can help reduce the cost of car insurance premiums.

Another benefit of no-fault insurance is that it can help speed up the claims process. Because your insurance company is responsible for paying for your damages, you don’t have to wait for the other driver’s insurance company to investigate the accident and determine who was at fault before you can receive compensation.

No-Fault Insurance Vs. At-Fault Insurance

At-fault insurance is the opposite of no-fault insurance. With at-fault insurance, the person who is at fault for the accident is responsible for paying for any damages or injuries that result from the accident. This means that if you are involved in a car accident in Arizona, you will need to prove that the other driver was at fault before you can receive compensation for your damages and injuries.

How At-Fault Insurance Works

Under Arizona law, if you are involved in a car accident, the person who is at fault for the accident is responsible for paying for any damages or injuries that result from the accident. This means that if you are involved in a car accident, you will need to prove that the other driver was at fault before you can receive compensation for your damages and injuries.

Benefits of At-Fault Insurance

One of the main benefits of at-fault insurance is that it can help ensure that the person who caused the accident is held responsible for their actions. This can help deter reckless driving and reduce the number of accidents on the road. Additionally, at-fault insurance can help ensure that you receive full compensation for your damages and injuries if you are involved in a car accident that was not your fault.

Conclusion

In conclusion, Arizona is not a no-fault insurance state. If you are involved in a car accident in Arizona, the person who is at fault for the accident is responsible for paying for any damages or injuries that result from the accident. While no-fault insurance can help reduce the number of lawsuits that result from car accidents, it is not mandatory in Arizona. It is important to understand the differences between no-fault and at-fault insurance when selecting a car insurance policy.

Contents

Frequently Asked Questions

Car accidents can be a stressful and challenging experience. One of the most common questions asked after a car accident is whether Arizona is a no-fault state. Here are the answers to some of the most frequently asked questions.

What is a no-fault state?

A no-fault state is one in which your own insurance company is responsible for covering your medical expenses and lost wages, regardless of who caused the accident. This means that you don’t have to prove who was at fault in order to receive compensation for your injuries. No-fault laws are designed to simplify the claims process and reduce the number of lawsuits that result from car accidents.

However, Arizona is not a no-fault state. In Arizona, the person who is determined to be at fault for the accident is responsible for paying for the damages and injuries that result from the accident.

What is the minimum insurance required in Arizona?

In Arizona, drivers are required to carry liability insurance that covers at least $15,000 per person and $30,000 per accident for bodily injury, as well as $10,000 for property damage. This insurance is designed to cover the costs of injuries or damage that you may cause to others in an accident that you are found to be at fault for.

It’s important to note that these are only the minimum requirements, and you may want to consider purchasing additional coverage to protect yourself in the event of a serious accident.

What if I’m hit by an uninsured driver in Arizona?

If you’re involved in an accident with an uninsured driver in Arizona, you may be able to file a claim with your own insurance company if you have uninsured motorist coverage. This type of coverage is designed to protect you in the event that you’re hit by a driver who doesn’t have insurance.

However, if you don’t have uninsured motorist coverage, you may need to file a lawsuit against the driver in order to recover damages. It’s a good idea to speak with an experienced car accident attorney to discuss your options in this situation.

Can I sue for pain and suffering in Arizona?

In Arizona, you may be able to sue for pain and suffering if you’re injured in a car accident. However, in order to do so, you’ll need to show that the other driver was at fault for the accident and that your injuries resulted in significant pain and suffering.

It’s important to note that Arizona has a “comparative negligence” law, which means that if you’re found to be partially at fault for the accident, your damages award will be reduced proportionally. For example, if you’re found to be 20% at fault for the accident, your damages award will be reduced by 20%.

How long do I have to file a car accident lawsuit in Arizona?

In Arizona, you generally have two years from the date of the accident to file a lawsuit for personal injury or property damage resulting from a car accident. This is known as the statute of limitations.

It’s important to speak with an experienced car accident attorney as soon as possible after your accident to ensure that you meet all of the deadlines for filing a lawsuit and to maximize your chances of recovering compensation for your injuries and damages.

In conclusion, Arizona is not a no-fault state for car accidents. This means that drivers involved in a car accident will be held responsible for the damages they cause. However, Arizona follows a comparative negligence law, which means that the amount of compensation a driver receives will be reduced by the percentage of fault they hold in the accident.

It is important for drivers in Arizona to carry sufficient insurance coverage to protect themselves and others in the event of a car accident. Drivers should also be aware of the state’s laws and regulations regarding car accidents to ensure that they are prepared in case of an unfortunate incident.

In summary, while Arizona is not a no-fault state for car accidents, drivers can still protect themselves and others by being knowledgeable about the state’s laws and maintaining proper insurance coverage. By doing so, drivers can ensure that they are prepared for any potential car accidents that may occur.

A passionate advocate for justice and fair compensation, Richard Norris founded ClaimSettlementPros to create a trusted platform that simplifies and demystifies the claim settlement process. With over two decades of experience in the legal and insurance industries, Richard has amassed a wealth of knowledge and insights that inform our strategy, content, and approach. His expertise is instrumental in ensuring our information remains relevant, practical, and user-friendly.

More Posts